🎮 A race to the bottom on creator royalties?

Shorts are analyses and opinion pieces originally published as a part of our weekly newsletter.

If you’re not one of the 11,000 subscribers of our newsletter, tap here!

Missed a previous newsletter? You can find them all here.

🚀 We look into the interesting world of creator royalties and whether games, especially those in the blockchain space, will join the race to the bottom.

On the go? Listen to one of our podcasts from this week, we’ve got:

🎧 TWiG #224 - Istanbul Recap / Silicon Valley Banking Meltdown / Do You Believe In Believer

Using blockchain technology to provide creative services has always been justified by the “creator royalty” that is taken every time an NFT changes hands. Instead of selling a piece of art and forgetting about it, web3 world offered the opportunity of rewarding creators for creating things that have high demand, thus changing hands frequently. This royalty was as high as 20% depending on the platform and the conditions of the market. However, with the long winter in the crypto market and a recession expected, marketplaces started looking for ways to create more volume by eliminating this fee.

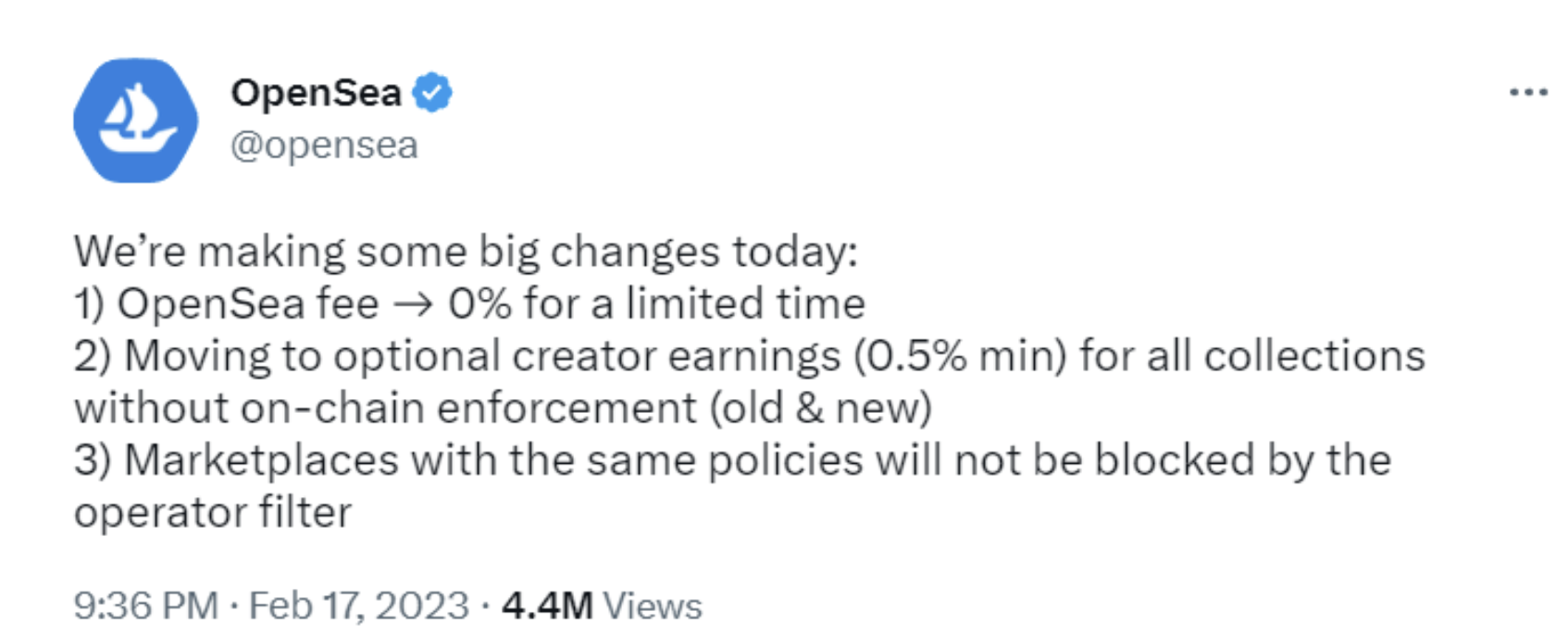

It first started with relatively smaller marketplaces like SudoSwap, X2Y2 or Blur that wanted to steal users from the giants like OpenSea and Magic Eden. They eliminated the creator royalties and decreased their platform royalty (the cut they take as the marketplace) to as low as 0.5%. There were push backs and some even had to go back to enforcing creator royalties, but OpenSea and Magic Eden couldn’t stand against this trend and decided to go with the flow. To make things even more absurd, OpenSea is now forgoing their own platform royalties for a limited time while making it possible to choose how much you want to give as creator royalty!

The things we do for volume…

This is certainly just a short term action from a company with one of the heaviest war chests that can survive with no revenue for a long time in exchange for having volume. It would be unrealistic to claim this is going to be the way every marketplace and project is going to adopt. One of the biggest arguments in favor of having your creative products on the blockchain is the possibility of the recurring creator royalty that can act as a sustainable source of revenue. Without it, there is less incentive for existing on any of those marketplaces.

The push for eliminating or decreasing creator royalties is coming from traders who want to flip NFTs day and night with the smallest cut possible. It will be easy for those traders to “wash trade” in order to increase the volume for a collection they want to pump. With lower fees, the same NFTs can be traded between the same people more efficiently, which will make any chosen collection seem way more attractive than it actually is. Then these traders can dump all of their NFTs at the peak and move on to their next pump & dump scheme. It’s hard to understand how something as obvious as this can even be a matter of discussion. I guess sometimes you need to take a step back in order to go forward…

Just a bunch of crypto rich people trading between each other (Source: poof.eth)

The thing with creator royalties is that they were not enforced, meaning they have always been optional. Until recently, marketplaces and creators determined the creator royalty together and adhered to this standard as a kind of social code. It was a way to keep the creator economy alive while still being able to trade NFTs in a sustainable way. With the debate of whether creator royalties should be enforced or not, idealistic terms like decentralization and being permissionless are discussed once again.

If things are evaluated from an idealistic perspective with little or no connection with reality, people might say “We should have a decentralized system with nothing enforced by a single entity”. However, we are missing the forest for the trees when we try to stick to a couple of high-level concepts instead of seeing the larger picture. As discussed above, one of the biggest incentives for creators to exist in web3 marketplaces is the recurring creator royalty. If that were to be eliminated for the sake of day traders, it means those creators would be back to square one, looking for alternatives.

And what does this whole debate mean for blockchain games? First of all, the art projects traded on web3 marketplaces all have a speculation aspect where their value is highly subjective without a clear utility most of the time. After all, they are a piece of art that can be evaluated differently by each and every person. So, games are in a different position compared to art projects when it comes to creator royalties since they are not meant for speculation and usually have a pretty straightforward definition of utility. At least, that’s how they should be…

So, for every blockchain game out there, whether to have creator royalties or not isn’t even a discussion. You cannot want any of those traders who are after quick wins by flipping your game assets since it will only mean that your game is actually a ponzi scheme. This is what happened with most of the early blockchain games and I don’t think anyone would argue against it.

The logic of selling and buying NFTs is quite simple: players want to buy those NFTs because they value the game and the place the NFTs have within that game. The floor price of the NFTs might go up or down due to several reasons, but it is not why they are there. They might want to sell their NFTs at some point because their NFTs appreciated a huge increase in value that they want to capture. At the end of the day, everything is for sale if the price is right. On the other hand, they might want to sell them simply because they got bored and don’t want to continue playing it even if it means being net negative monetarily. You should be fine as a player to be in that situation since you traded money for entertainment value just like any other game.

None of those possibilities have anything to do with creator or platform royalties as long as they are within a range that makes sense. Platform royalties were around 2-3% and the creator royalties were around 5-10% before all this nonsense about eliminating them started. Of course, how much you want to take as royalty depends on the asset type and community. If you have NFTs that will rarely be traded (like land), you might want to get a high fee since it’s not going to happen again any time soon. If you have NFTs that will be frequently traded (like weapons or armor), you will be fine with a low fee, because you know that same NFT will generate revenue over and over again. So, it’s more of a question of how you want to balance your creator royalty against the trading volume. The main goal is to maximize Trading Volume * Creator Royalty, so we might even see different percentages for different asset classes within the same game. One thing is for sure, none of this justifies eliminating creator royalties in games.

Finally, there is also the fact that blockchain games will most likely run free mints in order to start or continue their NFT sales. The entire monetization scheme of having free mints is based on the creator royalties taken from the secondary market. Blockchain games can hardly have priced mints in the current market conditions, so it is even more infeasible for any of them to go with this “no creator royalty” trend.

So, I think it’s safe to assume that games will not join this race to the bottom and will try to stay afloat through free mints and the creator royalties accrued from the secondary market. I’m also sure every marketplace will have to enforce creator royalties in the end for a sustainable ecosystem. It will make things less decentralized, but more beneficial for everyone which is the most important thing after all.

Written by Ahmetcan Demirel

🎙️ Deconstructor of Fun Podcast

🎧 TWiG #224 - Istanbul Recap / Silicon Valley Banking Meltdown / Do You Believe In Believer

The crew is back from Istanbul and what an event! Eric and Laura give Ethan and Phil major fomo about all the amazing people and sessions they missed at the gaming event of the year! We preview all the amazing Deconstructor of Fun content coming next week to GDC then get into the news. We talk about the further democratization of the Epic Games Store, Redemption Games' spin out of AppLovin', the total meltdown of Silicon Valley Bank and its effects on the gaming startup ecosystem, and the monster $55 million raise for the newly minted Believer Games.

Remember, if you see a member of the DoF family at GDC, make sure to say Mice Nuts 😂

Gaming Roundup

👾📡💎🙌🚀🥽📺

Report: PC and console global gaming dipped to $92.3bn in 2022

Netflix Games unveils Mighty: Quest Rogue Palace and teases upcoming game from Super Evil Megacorp

FTC seeks further details Microsoft's Nintendo, Nvidia agreements

Unity and Croquet partner to make multiuser games “automatically”

Twitch CEO Emmett Shear steps down

CCP raises $40m for AAA blockchain game in EVE Online universe

Xbox hoping to launch mobile game store as early as next year

Respawn opens new studio to bolster Apex Legends development

Microsoft Signs Third ‘Call of Duty’ Deal as It Seeks Approval to Buy Activision Blizzard

Game Developer Cancels GDC Appearance Following Death Threats