The Mobile Games Industry In the Year 2023

Welcome to our annual, highly anticipated, prediction series. Unlike the years before, we decided to really leverage our fantastic community of senior games industry folks to present you with trends that will shape our industry during the year. And we spiced things up by voting on the likelihood of each prediction.

The likelihood charts you’ll find at the end of each prediction are generated from responses from the Deconstructor of Fun community.

We want to thank the community for participating in writing these predictions. And we want to extend a special thanks to Jason Bailey for his initial set of predictions shared in the Deconstructor of Fun Slack channel. His example set a precedent for what you are about to read.

Oh, and those ball charts from the last predictions. Just signup for our Newsletter and you’ll be the first one to get them.

#1 Organic Discovery Will Be Declared Deceased

In 2023, the iOS and Play stores will be officially declared dead - and no funeral will be held. Featuring is a memory from the past. The k-factor, which measures the virality of a game, is at an all-time low. To get even more hyperbolic - the app stores are like that meme with the dog in a burning room.

The only good the stores do is give a landing page for our paid ads and distribute our APKs. If it wasn't for the hundreds of millions of eyeballs games send to the stores every day via in-game ads and paid user acquisition campaigns, they would be ghost towns.

Without impactful featuring, the only good the stores do is give a landing page for paid ads and distribute APKs. That wasn’t the case before and we have to talk about it.

And it’s not like the folks at the app stores are inactive. They’ve attempted to help us with presales, event cards, beta programs, QR codes, and a whole new set of price points. Yet the hard truth is that these initiatives by the platforms have done little except prolonged development cycles and created jobs inside the platforms themselves.

We worked for years to get featured by Apple. When we finally got the first big featuring (US+ elsewhere), after starting using the In App Events, it looked very promising. But while the impressions ballooned they hardly translated to page views let alone installs.

This was one of those surprise featurings. We didn't ask for the featuring, did not get to submit artwork for and just discovered a bump in impressions, which got us around 1.5 million impressions from browse, 40K product page views and 10K downloads (from source type app store browse). 50% of the downloads were reinstalls. Conversion rate from browse dropped to around 1% where it usually is between 5% to 9%.

At some point we were worried if the featuring even hurt the (organic) install numbers after the featuring week, but we couldn't find anything to confirm this gut feeling. It could have been just bad luck or something else.

We stopped working actively to try to get featured, both due to the worry of ending up with less visibility, and due to the fact that it didnt translate to business. But then Apple started reaching out and ask for promotional artwork. It just felt wrong NOT to submit, so we gave it another try.

But knowing what we know now about featuring, we just ask ourselves if it’s worth the time to have an artist make the art work requested? Could it hurt visibility after a featuring, by somehow decreasing visibility even for organic search? Is it the artwork in itself that is not selling the game? Or is it just that visibility is dead - even with featuring? Who knows. We also don't know if we are not getting access (yet) to the "good featuring".

By the way, it amazes me that Apple doesn’t even notify developers when they feature their games on App Store. A simple automated email would suffice.

- Executive of a small developer who has till date amassed well over 100M installs on mobile

The end of discovery also means that there will be no indie breakouts from small indie developers. Instead, the indie developers will have three options.

Sell their game to a safe harbor, such as Apple Arcade, Netflix, or similar.

Join one of the few powerful game companies taking over mobile.

Exit mobile.

Discovery is dead. Aggressive curation introduced into the App Store in 2017 was the beginning of the end. It’s too late to turn the firehose back on. Stick a fork in it and flip it over. It's done. This year it won’t be just Eric Kress saying it on the Deconstructor of Fun podcast.

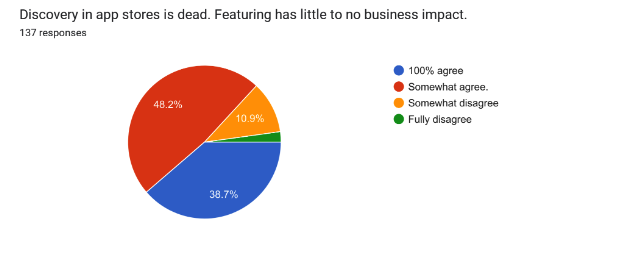

Likelihood of the prediction: 87%

Our senior community is nearly unanimous on the fact that app stores are dead. There were some companies that still received good outcomes on Google’s Play Store but on iOS it was game over.

#2 Publishers Push to Off-Platform Payments

What we love most about Apple and Google is that they know your credit card number. It is a beautiful thing, with a simple tap the money goes from your wallet into mine. Beautiful! We will absolutely pay a premium for this.

Also, they sell these amazing devices that EVERYONE has in their pockets AND they provided an easy way to access that massive audience through their app stores that are preinstalled on EVERY phone. Plus, if you were really good at smooching, Apple might feature your game and you would be blessed with millions of installs as hundreds of millions of users accessed the App Store every day to download new apps. A good feature would drive hundreds of thousands, and sometimes millions of installs. This gravy train took us all the way till 2017. Back then, 30% was a fair trade for this. Very fair. Problem is, that was then…

Today, organic discovery is gone, and featuring is dead. Features that used to drive a million installs now drive maybe 10 or 20 thousand installs at best. Nice to have sure, but won't make a business - or make us take the pilgrimage to Cupertino. Things are actually so bad that small developers are not eager to spend a few hours of artists’ time on artwork for featuring.

While the platforms’ value offering has significantly decreased game companies who account for 70% of app store revenues continue to pay the same percentage. Apple’s IDFA rug pull should at least have initiated the debate on what is fair.

Today, everyone knows our credit card numbers. You pay with your watch, your retina, and your fingerprint. You can just walk into Whole Foods, grab stuff and then walk out. Payments are easy now, especially micropayments. Expect to see heavy pushes to off-platform payments this year. A big win for companies like Xsolla.

In Apple’s attempt to destroy Facebook, they also lost the trust of their development partners. Funny that Facebook did exactly the same thing to us in 2011. Many of us remember 2007 when Mark Zuckerberg said 'build your business on our app platform and you can keep the profits’. Then in 2010 when game developers were making more money than they expected, they flipped the script and made Facebook Credits mandatory and exclusive, and demanded a 30% cut.

Where is Facebook gaming today? Dead. And has been for a decade. The app stores are playing the same game of chicken. Alternatives are emerging, and we will be forced to go there.

On behalf of game developers and publishers, here’s our simple suggestion that will turn the tide:

Reduce the store fees to 15%.

Give us back a usable IDFA with a reasonable privacy prompt

The points above will lead back to having a healthy ecosystem with a deep set of games and successful developers. We pray that the powers will listen. But our prediction is the meme dog that keeps saying, 'This is fine…'.

Likelihood of the prediction: 62%

Surprisingly enough, the likelihood of this prediction is low across the community. Many are looking into top up pages but the lack of clear cut cases might be the reason why the push hasn’t happened, yet.

#3 Paid UA Becomes a Break-Even Game

Advertising is a commodity and in a race to the bottom. The advertising networks know that if we make $10 per player, it is their job to sell that player to us for $9.99. They have more data than the publishers, which means that we can't win. We can buy revenue and reach, but it is increasingly difficult to turn a significant profit through paid user acquisition.

IDFA is a well-flogged horse. Even Eric Seufert is sick of talking about it. Google interstitial ad changes are necessary for the ecosystem's health. We can all agree that the user experience is terrible and should be policed, but if history is any indicator, this will do significantly more harm to the industry than good to the players. Because if done poorly, it could decimate hypercasual as well as the adjacent genres.

Ad spending is down, targeting is gone, interstitials are under fire, and margins are thinning. AppLovin and Ironsource were the big winners with IDFA killing Meta, but the shifting sands have settled. We’re short AppLovin and expect the new Unity IronSource to be flat at best. But don’t get us wrong. These companies aren't dead. Far from it! They will need a stroke of genius to grow this year. Things is geniuses do work there…

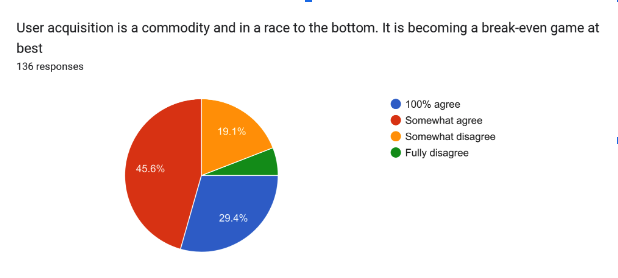

Likelihood of the prediction: 75%

Sadly, most od the community agrees that performance marketing is pretty much broken for them.

#4 The Safe Harbors Get Embraced

The combination of The App Tracking Transparency recession and the actual recession means that Apple Arcade, Netflix’s publishing deals, and IP partnerships are more interesting than ever.

Previously you could spend $2M and build a game with a half-decent chance of making between $25M and $100M in lifetime revenue. With effective live services and functioning performance marketing, we could eke out a 15% margin and thereby achieve a 2x to 10x return on investment.

Those numbers are on their head now with development costs increasing steadily. It costs $4 to $5M to develop a decent game while growing a game is more difficult than ever. As stated before, organic discovery is destroyed and paid marketing is reduced to a formula with a thin margin. The 2x to 10x ROI is more like 0x to 4x today.

A deal from a partner where a developer spends $5M to make the game, and $3M to run it but gets paid $10M from Apple/Netflix/IP starts to look mighty good. At least the developer made $2M, which is more than can be said for 99% of the games launched last year in the post-ATT free-to-play world. No moon shots, but at least you are on base, in business, and default alive.

Our suggestion to all the game developers out there is to make the most out of these safe harbors while they still offer that sweet protection from the raging storm. Continue to the next prediction for context…

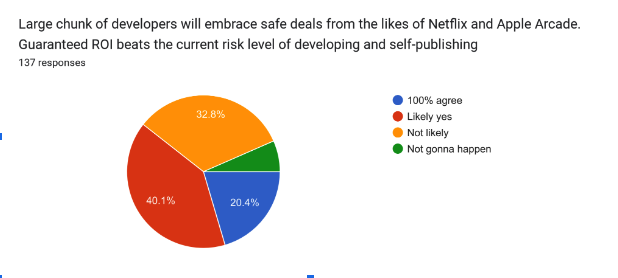

Likelihood of the prediction: 60%

Interestingly enough, many seniors in the community are not, yet, ready to embrace the safe harbors. Maybe we should ask this question again towards the end of the year…

#5 Streaming Platforms Move into Mobile Games - for Now…

Streamers like Netflix, Disney, and Amazon have eyeballs on mobile. And that’s a lot of eyeballs. There are two reasons for this. Firstly, pretty much all of their users are engaging with their service through their mobile devices in addition to TV screens. Secondly, these gigantic streaming platforms are engaged in ruthless cutthroat competition for subscribers and content. With Netflix as the first mover among the streamers, we are bound to see others following as they cannot risk losing any potential advantage.

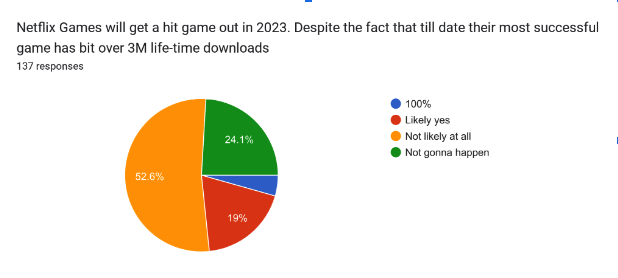

Will Netflix launch its first proper hit game in 2023? By a hit game, we mean a game with around half a million daily active users and some 25M installs. A game like that won’t change Netflix’s core fundamentals, but it will indicate success for Netflix’s games division to a point where the executive teams there want to continue doubling down on games. And as they double down, other streaming platforms will follow.

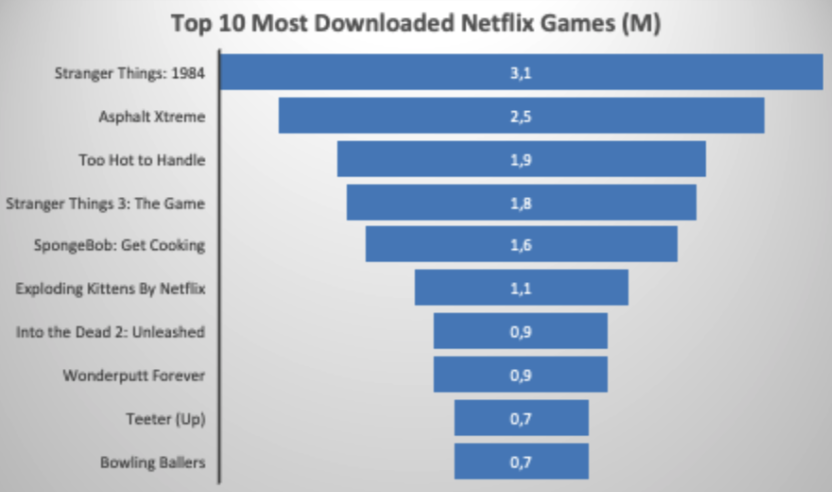

But let us get realistic. While Netflix in theory has everything and more to hit the jackpot, in reality, every game so far has been throwing spaghetti at the wall. And looking purely at the numbers, that spaghetti hasn’t stuck. Their Apple Arcade strategy of premium games and former free-to-play games stripped of in-app purchases has resulted in 27 million installs across 50 titles.

n 2022 Netflix Games had no success on mobile despite heavy investments and offering beyond top-of-the-market salaries to its gaming hires. The company has released over 50 games that have generated 27 million installs. It wouldn’t be far-fetched to argue that the games would have gathered at least twice the amount of installs outside the Netflix app.

We don’t know how hard Netflix is cross-promoting games inside the apps. Our hope is that they have put in no effort in driving traffic to their games. Otherwise, we’d be worried…

As Netflix doubles down on games in 2023, we expect to see the other streaming giants dipping their toes and leveraging their platforms to drive traffic to their games. Disney, Roku, Amazon, HBO, Paramount, Hulu, and a heap of other Free Advertising Supported Television providers. This also means that the streaming giants will be looking to license their IPs so that they can get games into the market they can drive traffic towards. Though most are going about it in a small way and not giving it the chips it deserves and needs. Netflix is the only one risking real chips right now and thus the only one who can win (or continue to lose) big.

As a counterpoint, if Netflix Games fails to deliver a hit game in 2023, it will be very hard for the games division to continue to burn cash as they have to date. The market is already vastly different than it was when Netflix kicked off its games business. The recession is real. The interest rates are real. Inflation is real. That means consumers’ disposable income is constantly going down and investments in growth are increasingly more expensive and risky. In other words, 2023 will either make Netflix a formidable player in gaming - or be the year when Netflix decided to stop its push into mobile games. The implication of Netflix’s decision will have a significant ripple effect because whatever they do will be mimicked by other streaming platforms.

Likelihood of the prediction: 76% believe that Netflix will not launch a hit in 2023

The Deconstructor of Fun community doesn’t have high hopes for Netflix Games’ chances of delivering a hit game on mobile in 2023. But then again, they are throwing a lot of spaghetti at the wall. Chances are, something sticks…

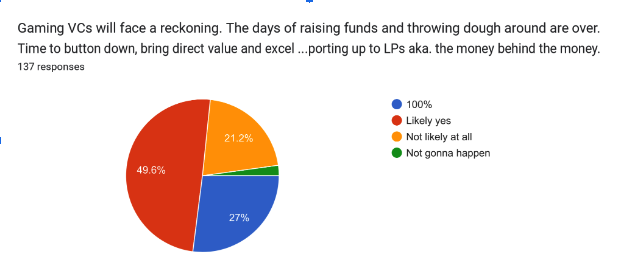

#6 Venture Capitalists Will Face a Reckoning

Last year venture funds started pulling back on investing. We can see this, especially in the drop of growth stage investments that were lower in Q2/22 than it has been in the past years.

Source: Konvoy Ventures Newsletter

What the decline of deals means for the industry is that many, and we mean MANY, startups will die. They simply don’t have the capital to survive the next 18 to 24 months of recession if they are not profitable already. Investors, who were previously generous with their investments are less so now because they can’t raise funds like they were able to do just a year ago. And the funds they have will be invested into early-stage companies and used to support the most promising companies in their portfolio. Everyone else will be caught in the middle and will have to figure out their way to a safe harbor or drown swimming there.

And when it comes to early-stage investments, we need to say farewell to the super generous pre-seed and seed checks investors were giving from 2020 to 2022. If a team was able to raise $4M with a cool PowerPoint deck and a lofty promise of Web3 magic in 2021, today the same team will need to show a convincing demo and a waterproof plan to get a quarter of the money with much worse terms. In other words, we’ll continue to see lots of investment activity but the investment sizes will be much lower and selective. After all, investors can’t just sit on their money and extract the sizeable fund management fee if they are not making deals.

But gaming startups are not the only ones who will face worse investment terms from investors. You see, every fund is comprised of Limited Partners (LPs) who are the money behind the money. These are super-wealthy individuals, family offices, mutual funds, and other gaming companies. Given that the market has changed significantly for the worse, it is expected that the LPs will begin to demand more from the Venture Capitalists (VCs).

What this means in practice is that the General Partners will have to get their hands dirty again. The last couple of years allowed (gaming) funds to raise hyperfast funding rounds, which in turn lead to an increased amount of management fees a fund receives (typically 2% annually of the total fund value). With more management fees the General Partners were able to hire more people, grow their organization - and in some cases take a bit of a step back from the day to day grind to enjoy some of the carry made (General Partners receive a % when a company they have invested in is sold. This % is known as a “carry”).

As Joakim Achren put it in his wonderful newsletter “There are no recent benchmarks on what a great product, go-to-market, and M&A could look like for a new company. Conviction to invest comes from the data, which leads to the excitement that guides VC, and currently, there’s a significant lack of excitement to fund gaming companies.”

At the moment, VCs are, rightfully so, demanding CEOs in their portfolio to level up their reporting game. Provide more visibility so that investors can help them. We expect the same expectations to apply to VCs themselves. LPs will simply not settle for giving money and hearing from the VCs once in a full moon when they are raising another fund. The most proactive investors are already getting back to setting up advisory boards with their LPs and significantly improving their communication.

You’ll also see much less self-promotional material coming from General Partners. There’s no time to be a half-time investor. Writing books and creating courses have to wait for the next bull run. The reckoning has begun.

Likelihood of the prediction: 77%

The Deconstructor of Fun community, that has lots of gaming VCs in it, believes that the easy days at private capital have come to an end - at least for short while.

#7 You Will Get Back to the Office - Fully Remote Becomes an Anomaly

Spending time together with your coworkers is simply necessary in a creative industry like games. We expect this to become the norm again. We do reckognize that hybrid work is here to stay while remote work will become an anomaly. Something that mainly startups offer to attract talent where they otherwise couldn’t.

"To become the absolute best place to work, communication and collaboration will be important, so we need to be working side-by-side…That is why it is critical that we are all present in our offices."

Marissa Mayers shortly after becoming the CEO of Yahoo

In 2021 Marissa’s message was a blast from the past. Just a year later we see almost all of the prominent tech companies making not only similar statements but actually doubling down on on-site work and demanding staff to either return to the office or leave the company.

A recent study suggests that nine in ten employers want to bring workers back to the office in the New Year. Those employers listed communication as their top concern, followed by creativity, productivity, company culture, and employee oversight. Chances are, your employer is one of those nine. And we can almost guarantee that the leadership of your game company has been praying for this day to come.

Before the lockdowns, there were companies like Super Evil Megacorp, Belka, and Playrix (to some extent), that adopted a remote work structure. And these companies did share actively their remote-first processes, tools, and guidelines. Yet, remote work was more of an anomaly than an alternative. Until today, where the situation is reversed and fully on-site teams seem to be rare and far between.

There are many great benefits in a fully remote setup, as we all have come to realize:

You can recruit people from more locations. The best talent may not happen to be living nearby or be willing to relocate. This is fairly important because most, if not all, companies have issues recruiting senior employees.

Remote work is employee-friendly due to the lack of commuting required.

It is also cost-effective as you don’t need to have a physical office and you don’t have to compete with a salary to get the talent living in high-cost cities.

Not to mention that remote work can be more productive as employees can focus during the day instead of being distracted by conversations or spending time on long lunches and extended coffee breaks.

The issue is that people who are not in a management position, very often lack the ability to see the challenges with remote working, and over-focus on the advantages of working from home brings to them on an individual level. It seems very easy to focus on what works best for me - not what works best for my team, the project, or the company. While in a management position, it seems to be easier to see the challenges related to company culture, lack of communication, or even miscommunication that may lead to frustration and overall poor performance.

We don’t talk about the challenges in communication that arise when all discussion is done on message boards and video conferences. A written word from an avatar is not the same thing as a discussion face-to-face. Lack of human interaction easily leads to loss of nuance, which is vital in how we as a species communicate.

There’s no talk on what the organization might be missing out on from ad hoc conversations between co-workers at the coffee corner or during lunch breaks, or even just bypassing each other in the hallway.

Companies also don’t like to mention the lack of loyalty that comes from having a fully remote setup. After all, if you’ve never even met your colleagues in real life, you likely lack a deep sense of community you’d be leaving behind should you change jobs. Thus the only reason to stay is an interesting project and good pay.

Hiring the best people from different countries and paying people in many countries becomes a tax and legal nightmare.

Remote work burns people more and is in general more stressful because it is harder to onboard people, teach new processes, and have knowledge sharing.

Most importantly though, how can you build an engaging and outstanding company culture in a fully remote setup? What tends to happen is most company cultures, that adopt remote work, look alike. They focus on empowerment, clarity, efficiency, and work-life balance. These are simply the ways of working that are the result of remote setup. They are often not the desired outcomes for a culture that has led to a fully remote way of working.

For a while, companies have had the option to recall their employees to return to work on-site. Yet a lot of the companies were afraid to demand their employees to do so due to the fear of employees leaving the company to work for a company that allows for remote work. The management was afraid that their attempts to correct the issues on-set by mandated remote work were seen as a lack of trust towards employees working from home.

But that was before the global recession. Before the ongoing onslaught of tech jobs. Now the ball is back in the employers' court and they will do what they see most useful for the overall good of the company instead of maximizing the benefits of individual employees.

Work-life balance and empowerment are undoubtedly important for any game studio to compete for talent. These two vital elements will allow a company to retain employees they’ve fought to hire and train. Offering a great working environment is also a massive selling point that can help, attract the talent you normally couldn’t perhaps afford.

In the end, remote or on-site work shouldn’t be a partisan issue. Because the best way of working for any studio is the one that maximizes the success of their games. If the performance of the studio is at its peak with teams being mostly on-site, then the leadership and the team have to bite the bullet and move into this model - even if it means losing some people who refuse to follow. The same goes the other way around.

In other words, remote work will become an anomaly with very few successful implementations that will be touted by underperforming teams on why they should also remain fully remote. Hybrid work will become the de facto model with companies offering a few remote days at the approval of a manager.

Likelihood of the prediction: 70% (roughly)

Here’s where our community was aligned that on-site work is back while being torn by various definitions. Most don’t believe that pre-lockdown form of working will be back. Instead they forsee employers taking harded stances on set amount of days at the office.

#8 You Might Get Laid Off

As we are writing these predictions, we’re less than a month into 2023 and already 185 tech companies have laid off 58,000 employees. And the pace of tech layoffs seems to only increase. Open up Linkedin and you’ll see endless posts from folks who have been affected by mass layoffs. Often in very insensitive ways as well.

And this is really, in many ways, unprecedented. As the lockdowns ascended, the consumption habits changed. White collar employees stayed at home, ordered food, shopped from their mobile phones and played games. The tech companies all thought this is permanent and hired against this new world order - or metaverse, if you will.

But lockdowns are gone and people actually returned back to cities. People are going to music festivals and expos instead of attending them virtually. For sure there was a shift in human behaviour, but it wasn’t a permanent change to a life inside four walls that the tech companies were predicting.

Then there’s the end of free money. After printing their way into inflation, central banks are now raising interest rates seemingly every month. The combination of high interest rates and high inflation is literally slashing the wealth of ordinary people while at the same time destroying jobs as companies stop investing.

Finally, there’s the Elon Musk effect. After cutting the majority of the Twitter staff, the app is still up and running. Sure, they are running out of money, but that’s mainly because advertisers pulled out. And it's not like Twitter was profitable before Musk. Nevertheless, other tech CEOs are looking at Twitter layoffs and likely thinking that they can easily layoff 10% rather than 5% of the staff without any effect on business. And as one big tech company cuts 10%, their rival will cut just as much to make the shareholders satisfied.

So how do this all relate to you? Well, we in games are considered as tech employees. And gaming is not immune to a recession. This might have been the case in 2018, when the only form of games we had was Console and PC. Today we have free-to-play games, subscription based games and all the other entertainment that wasn’t competing for the same limited money and time. Spotify, Netflix, Tinder and YouTube all compete against the biggest free-to-play games and the Xbox Passes of the World.

But let's not get all doom and gloom. Many of the laid-off employees will start new companies. And those startups will eventually rival the companies that laid them off.

Likelihood of the prediction: 31%

The community of senior folks doesn’t believe they will be axed. Keep in mind that most companies will cut on outsourcing and demand employees to move back on-site. This will lead to job cuts at outsourcers and fully-remote people choosing to exit on their own. And then there will be startups that will run out of money during next 2 years.