Royal Kingdom: Will it Usurp the Throne or Just be a Royal Relative?

Written by Laura Taranto and Ahmetcan Demirel, both senior product leaders with vast experience in casual games.

Tune in to the Deconstructor of Fun podcast where Laura co-hosts the notorious This Week in Games (TWIG) segment and make sure to read Laura’s previous analysis: Royal Match - The New King from Turkey?

the editor’s note:

Why should you care about Dream Games? Well, maybe because this Turkish startup established by former Peak employees, launched its first game, Royal Match, in 2020 and has to date amassed $906M in cumulative revenue with just 105M installs.

Just to repeat: Dream Games’ achievement to date is unprecedented. They launched a new game from a new studio entering the most competitive genre on mobile in the midst of Apple’s privacy apocalypse and has generated a billion dollars in revenue in two years.

The question, which our latest analysis aims to answer is, can Dream Games repeat their success with their second game or are they a one-hit-wonder?

When you’ve reached the top echelons of success, where is there to go next? We see many big players try and answer this question: Supercell has experimented with new genre pioneers in the Player vs Player (PvP) mid-core space (Clash Mini, Clash Quest); King launched Crash Bandicoot: On the Run attempting to find a new way to monetize the endless runner genre; Playrix is taking their tried, true and well-copied decoration meta and exploring hidden object territory. What these companies have in common is that they’ve carved out an area of expertise and are attempting to find a new angle to dominate and expand, usually with an audience that has some affinity for their existing portfolio. Dream Games has joined that list by bolstering its hold on match-3 puzzles and widening its already mass-market audience through the addition of its newest game, Royal Kingdom, which features one of the smoothest casual PvP designs in the market.

Top Match-3 Games excluding Blast over the last 52 weeks, iOS/Android, Worldwide

Dream Global launched their first game Royal Match in February 2021 and it’s been a top-grossing game ever since. Despite Apple’s disruption of mobile advertising with IDFA deprecation a few months later in April, Royal Match still managed to maintain its growth, with a few caveats. We’ve seen a recent minor drop in RPD as of January 2023, as while downloads spiked, revenue has maintained consistent growth. It looks like Royal Kingdom’s launch did give a boost to Royal Match, with respect to downloads and revenue. Without insight into their plan and profitability, it’s pure speculation from our perspective. And while still too early to truly compare, the soft launch RPD data for Royal Kingdom is promising.

Back to the original question: what’s next? There are many ways to move forward when you have the best in class match-3 switcher engine in the market. Instead of one upping the engine they built, they are looking to expand vertically by redefining competitive social. We assume that Dream is attempting to expand beyond their primary audience by introducing casualized midcore inspired gaming elements.

What’s the same and what’s new?

Understanding where Dream intends to go first requires looking at the delta between their two games, Royal Match and Royal Kingdom.

Royal Kingdom’s level design is effectively the same as Royal Match’s. From the board pieces to the look and feel, it would be difficult to distinguish between the two. There are minor changes here and there, but nothing a player would likely notice or be able to recall. This makes sense; in context, why change a formula that works if you don’t need to? One could even suppose that it makes content transfer (levels, features) even easier between the two games. In the first 101 levels of Royal Kingdom, they use (and re-skin) most of the obstacles that we know and love in Royal Match.

Boards from Royal Match (left) and Royal Kingdom (right). Try to spot any difference.

Creating a signature brand with their widely appealing style

Like King with “Saga” and Playrix with “‘Scapes”, Dream is carving out a brand establishing “Royal” as their signature. And what would a brand be without a cast of characters? While King Robert does not make an appearance in this game, they keep it in the family by sending his brother King Richard (if there is an R theme going, then will King Ryan or Raymond be next?). In a time when finding users is tough, it’s sensible that they want to leverage their IP in order to decrease CPI, even at the risk of not capturing a different enough audience. And while not always a perfect solution for profitable user acquisition, brand recognition can make a difference. There might be a lot of casual puzzle players who either churned out of Royal Match or simply can’t get enough, and now can have another go with Royal Kingdom.

King Robert (left) and King Richard (right). Royal Kingdom store description mentions other cast characters. Wonder how they will expand their Royal-verse.

Now onto the differences…

A new way to define ‘casual player vs player’ (PvP)

The biggest glaring difference between the two games is the new attack mechanic that is baked into the natural linear progression and appears every 10 levels. This is Dream’s big swing in discovering what players might love next: They are placing their bets on social.

A sequence from the first enemy attack level in Royal Kingdom

At first play, this new addition is reminiscent of features you’d find in midcore games. If we were to wager a guess, the mechanic itself was inspired by Zynga/Small Giant’s Empires & Puzzles and the look and layout by Supercell’s Clash Quest and Clash Royale. As a refresher, in Empires & Puzzles, every move on the board, which occupies the lower half of the screen, transforms into an attack on the enemy in the upper half of the screen. While it may appear complicated, Dream’s team made it a beautifully simple design, where damage is based on how many pieces are cleared and boosters activated. Your “opponent”, which appears to be either a random player or friend (frenemy?), represents the castle you need to take down.

It is also important to note that there is currently no “defense mode”; there is no configuration or protection from an attack, the layout of the castles are likely designed by the level design team and so far, a feature like “shields” do not exist. Damage to your castle sustained, and notification of said damage, is similar to Coin Master in that it is passive and indiscriminate. Repairs cost Potions, a new currency in the game. Leading to the next key difference, the economy setup.

More than just stars

Rewarding players with a currency that can be used in the metagame has become a common practice within the casual puzzle space. Made famous by Playrix’s Gardenscapes and Homescapes, many new casual puzzle games have incorporated it as a way to expand play beyond levels. There seems to be two primary ways of integrating end-game rewards into the metagame:

Giving a resource (like a star): Gardenscapes and Homescapes give one star for every level their players beat (with some exceptions like first attempt). These stars can be traded for renovation as well as other tasks within the meta.

Giving a currency: Project Makeover and Property Brothers provide players with currency, like coins, for each level they beat. This allows for more flexibility as designers can choose and adjust the output based on a more complicated formula. Want to incorporate a little bonus for score (if the game has score)? Much easier with a currency.

Mini games in Homescapes and Project Makeover are excluded.

More than this, Dream has also decided to add Player Ranks, fueled by XP (experience points) in addition to keeping coins, which fund out of moves purchases. Why would Dream make this change between games? As mentioned above, awarding currency instead of a resource allows for a few tricks:

Bigger reward numbers are more exciting for players

Designers maintain more control and more flexibility over the inputs and outputs, e.g. game economy

Puzzle games become notoriously reward starved if they only have 1 currency and boosters.

To better explain that last point, think of simple games with only 1 spendable currency (maybe coins, gold bars, diamonds, gems, etc) and boosters. If you are adding features to your game (which one does as a live service), each new feature needs rewards. If you are limited in your rewards, then you end up rewarding the same items over and over. This is one potential cause leading to inflation if not managed properly. While adding in currencies does create more overhead, it does allow for reward variety in the future, which is key for games that intend to live for 5+ years.

Popping back to rank - Why add rank and why give it a strong real estate presence? We can think of a few reasons. It’s an additional visual progression mechanic, which we know works well for the audience. It’s another way to shard players. In the early to mid stages of the game, most players will have similar ranks and similar progress. But it’s likely that as players move to elder content, it’s a better way to finely track their relative skills and progress than level alone, especially without the simple equation of levels equaling star progress. If this game is going to expand social, having another measurement like rank will help with matchmaking, which can yield better results in terms of engagement and monetization.

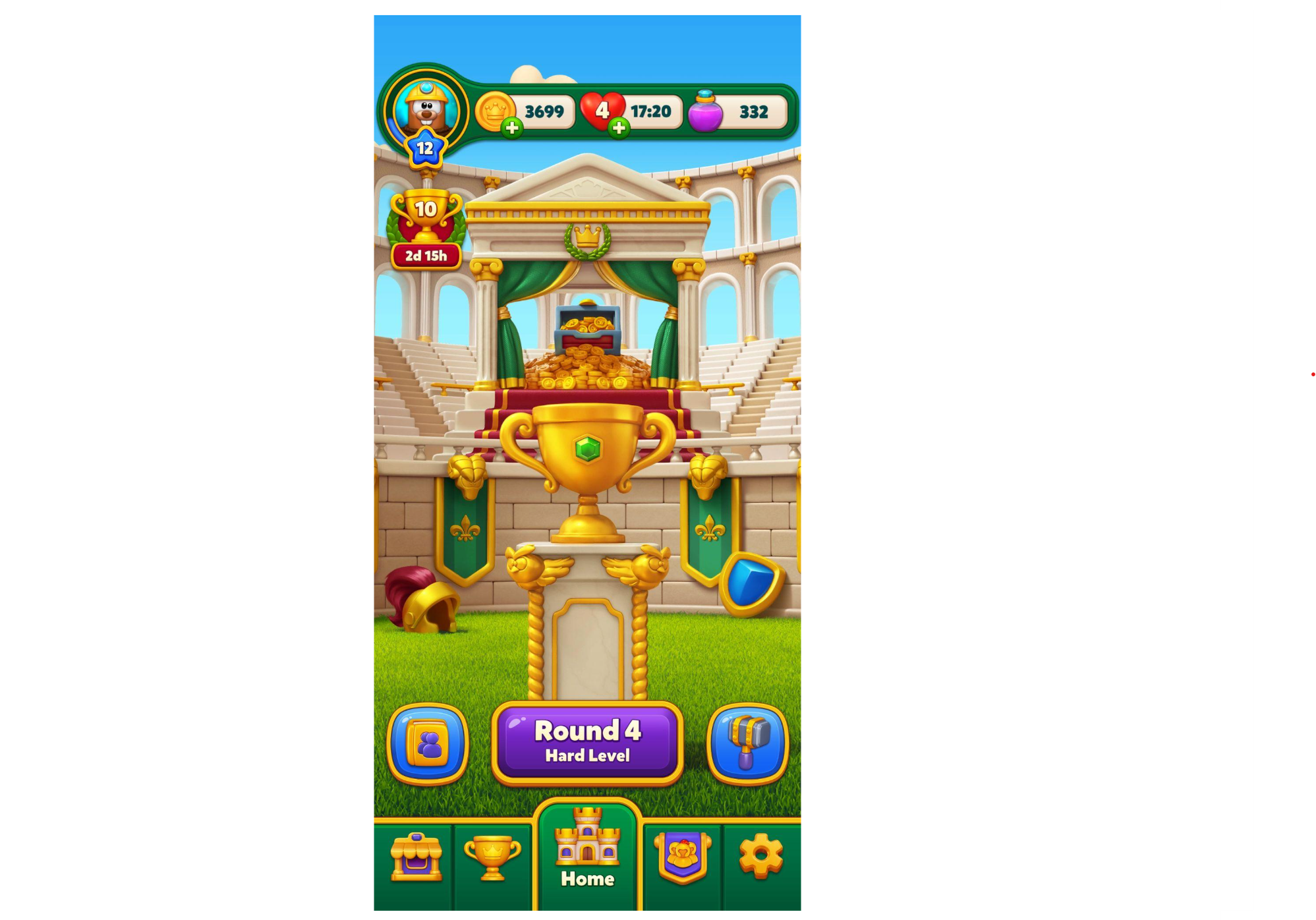

Royal Kingdom’s home screen.

Player rank does not only affect the user interface and future matchmaking, but also the game loop. This gameplay loop is longer and more complex than Royal Match’s. While Royal Kingdom starts with the well established "Play Level > Earn Reward > Renovate" loop, they add another layer with player rank. A visualization of the game loop looks like:

A whole new perspective

Royal Kingdom’s new approach to light decoration/renovation feels much better as an isometric map divided into districts rather than a singular space. At the moment, the current soft launch build is focused only on the present outdoor areas, a contrast from the interior decoration that also existed in Royal Match. That’s not to say they won’t expand into interiors, but we would imagine that, if it were to happen, it would be an events layer or a mid-game add for variety. While this new map may not contribute directly to revenue, it is lovely to look at and gives the player a way to take in a high level overview of what they need to do - fix the Kingdom (long term goals for the win).

The areas that are built vs. some of the areas waiting to be unlocked. Completionists may be offended by the second image…

To build out the map, players spend potions to create buildings and other spaces on the map. Doing so earns them coins and xp (that ranks up the players).

Supporting our original thesis that Royal Kingdom is targeting a more sophisticated casual player that enjoys competitive social, this map also follows what we typically find in empire building and simulation games. While this isn’t the strongest connection between the two, it’s worth calling out.

Win streak’s importance - redefining a playbook feature

Win streak, which is typically defined as rewards for consecutive wins, is a standard in puzzle games today. In match games, the player typically wins boosters that in turn perpetuate the player’s ability to win a level in one go. A hard level can risk losing the streak, which can feel quite painful. As if starting a streak over wasn’t difficult enough, Royal Kingdom doubled down on this feature.

The real and, arguably, more important reward players get out of their streak is doubling the end game reward, which, as mentioned above, is potions. This completely changes the progression for each player. Royal Match and other games also have mechanics to let players earn more metagame currency for a faster progression. However, they typically (but not always) are served through events or mini games that are not permanent or tied to the core gameplay. Being able to double your potions and use them to build more buildings, thus earning more XP and unlocking more districts, creates a satisfying feedback loop full of perceived player agency.

If you have a 5-win streak, you get the power ups at the beginning of the level and the extra potion at the end of it. Great way to keep rewarding the player.

Of course, with this additional benefit, players are further incentivized to keep their streak. On the other hand, doubling the end game rewards basically means progressing through the metagame much faster. As previously mentioned, other games offer players the chance to earn additional metagame currency, but usually only for a limited time (as part of an in-game event). Having the possibility to double it permanently is a great game changer for how to design, create, and release content. Considering the fact that Royal Kingdom gives more potion to hard levels (x2 for hard and x5 for super hard) and enemy attack levels (x10), keeping your streak for 10 levels is going to make a significant difference.

Which Kingdom will take the spoils?

Dream’s changes to Royal Kingdom strongly suggest a move to expand their network by capturing players that like puzzles but also desire a slightly more sophisticated game, a tangential audience to match-3. These changes are slightly bigger than what could be classified as an incremental change: the PvP is likely only the beginning. It is likely to expand over time and that, combined with a deeper economy, suggests more of a divide between the games as opposed to any sort of future convergence. But it’s worth reiterating that the cleverness in approach (same engine, different metas) also allows them the most efficiency within their content pipeline as both games can likely draw from the same level designs and levels are key in puzzle games. The big question is will this approach yield the result we believe Dream wants?

We’ve been debating this point. Looking at the history of “sequels”: Candy Crush Soda Saga only earned about 75% of Candy Crush Saga’s revenue at launch and never overtook the original in its lifetime. When Homescapes launched, on the other hand, it did outperform Gardenscapes at times, but hasn’t held the position consistently. And on the flip side, Toon Blast left Toy Blast in the dust. Regardless, it’s difficult to compare without analyzing the overall decisions made: talent, user acquisition strategy, roadmap and optimizations all can have a dramatic effect on a game’s performance. For simplicity, let’s assume they were similar and acknowledge that they launched way before the IDFA changes. Returning to the question at hand, will Royal Kingdom outperform Royal Match?

Our predictions on performance are not unanimous:

The bearish are more pessimistic about it outperforming the original title. Not just because of IDFA and the difficulty of scaling a game, but Royal Match’s worst performing day (with respect to ranking) in the last 3 months still kept it at #4 in top grossing in the US - very little can take this game down. Even games that have already scaled barely keep up. Since Royal Kingdom looks like it will have a bit of a different core audience, it’s uncertain they could ever scale it that large even if they wanted.

The bullish believes that there is a chance it will outperform the original. The puzzle market definitely has more mature players than 5 or even 3 years ago. Games are prolific and younger cohorts are certainly savvier than the older generations that were adults when mobile gaming first took off. Dream has also kept what has worked: broad market theme and art style, the strongest game engine available; and reimagined and added what has worked and succeeded in other subgenres: PvP, social competencies, and a reinforced game loop, and it’s combined into a product that is elegant and polished. The wager here is that the success of the titles that contain these elements are mass market hits so there is a large enough audience.

While we have different expectations on the mid to long-term performance, we agree that Royal Kingdom will draw in players beyond the typical puzzle audience. And if successful, we believe that we will see a wave of this new casual “PvP style” and Royal Kingdom become the next blueprint that many will start to build from.