Google x Deconstructor of Fun Istanbul Event: Highlights and Videos

Google and DoF brought together the most influential gaming investors, companies, and talents in Istanbul! Gaming expert speakers talked about the hottest topics in the gaming industry from 2022 predictions to rising game categories, from blockchain & NFT gaming to launch strategies.

Friends at mobilegamer.biz summarised every talk and session and divided them up so you can watch each one by hitting play on the embedded video.

Mobile games market predictions in 2022

Michail Katkoff, Savage Game Studios, and Deconstructor of Fun

Katkoff started with some high-level trends from 2021:

Casual games downloads and revenues are still growing and will continue to do so

Midcore games downloads and revenue growth isn’t so strong but remains the largest in terms of IAP spend

Casino games are facing challenges in revenues and downloads post-ATT

Overall game downloads were down from a record year in 2020, but not as much as expected, and consumer spending continued to increase

The number of new games released is down, suggesting a maturing market, post-ATT challenges, and how hard it is to ship games while working remotely

65% of all revenues are going to the top 100 top-grossing in the US app stores, a larger proportion than in previous years

The number of games making $100m+ a year did increase, but is slowing down

23% of the top 100 top-grossing games are essentially mainstays in the top 100

Then he went into IDFA – a “Ragnarok on user acquisition”. This has led to a resurgence in the value of IP in the market, as it is now harder to get new users.

Understanding players and marketability have also become more important, leading to larger companies increasingly building content fortresses – in which they acquire a user and move them between games in their portfolio.

2022 predictions:

Casual games will become more audience-led because of ATT

Hypercasual will continue to see more hybrid IAP/ad monetisation and will become even more ‘Android first’

Midcore games will go increasingly cross-platform (particularly on PC). Game-makers will partner on more IP collaborations, push into alternative payment systems, and make more sequels(!) following PUBG New State, Free Fire and COD

Casino games were supercharged in 2020 but casino game companies are diversifying ahead of what many predict will be a general long term decline

Shooters are poised for growth, but battle royale is slowing down and more blockbuster IPs are entering the market (Apex Legends, Battlefield, Valorant)

Changing ecosystem and reflections on gaming

Sencer Kutluğ, Google

Kutluğ started by talking about games as a positive force during lockdown(s), with multiplayer online games bringing people together.

Then there was a ‘big numbers’ slide:

$180bn total revenue from games in 2021 (52% from mobile, 40% of players across platforms are women)

3bn gamers in the world, 46% of those are women, and more than 30% in the US identify as non-white

11bn watch time hours of live gaming streams on YouTube

Market challenges

Players increasingly want to play across platforms and different screens – and that’s hard to do

Regulation is happening in Asia and could come to other parts of the world

Privacy – “it’s gonna be messy”. Cookies and device identifiers will degrade; the industry will move to rely on aggregated and anonymous data; marketers will need to rely more on modeling, and get first-party data to get better signals

What players want in 2022

Player expression: more than just skins

User-generated content: players want to create, co-create and share with the world. Sometimes for monetary reasons, sometimes just to express themselves

Play to earn: early days right now, but it’s coming

He wrapped up by talking through what Google is doing in the community – its Gaming Growth Lab, Incubation Programs, Talent Bootcamps – and stressed that the Google team is here to help.

Mobile gaming megatrends

Eric Seufert, Mobile Dev Memo

Mobile ad spending worldwide is going up and shifting faster than ever from traditional channels like TV, OOO into digital. Mobile ad spend will be over half of all media ad spend by 2024

Apple’s Intelligent Tracking Prevention in Safari was the catalyst to radically altering the digital marketing landscape. ATT in iOS 15 went harder. Mail privacy protection, using Apple’s ‘hide your email’ service, also having an impact. Google’s recently-announced privacy changes kind of mirror what Apple has done

Fingerprinting’s days are numbered, Seufert predicts, possibly with iOS 16

Regulation, in particular the EU’s Digital Markets Act, could open up app stores. Plus the EU’s Digital Services Act, coming soon, could also impact marketers

Post ATT walled gardens: Apple, Google, Facebook, Amazon will only get more powerful, which is already leading to huge consolidation among third party data and ad firms

Advertisers will now be showing ads to broader, less relevant customers, so game-makers must make the games themselves more personalized. You can then use those signals to give the player what they want and determine who the valuable players are. Then you can personalize the game experience, IAP offers, and ads

Post ATT there will be a move from ‘Low ARPU, High DAU’ and ‘High ARPU, Low DAU’ games to the middle. So monetization will be increasingly driven by a combination of ads and IAPs

Fireside chat: Tel Aviv, Helsinki, and Istanbul – building blocks of a thriving gaming cluster

Affan Butt, Aream & Co; Joakim Achren, Elite Game Developers; Chris Petrovic, FunPlus; Elad Kushnir, angel investor

Elad Kushnir on Israel:

The scene started in the late ‘90s with the real-money gambling industry, then the talent moved into companies like Plarium, Playtika, Moon Active, Crazy Labs

Liquidity and funding: Investors like vgames and NFX have supercharged the market

Joakim Achren on Helsinki:

Got going in the ‘90s with the Demo scene, then Remedy broke out, then Nokia, then Supercell and Rovio happened around the same time. Many spun out from Nokia, Rovio, and Supercell. The scene has stabilized a little now.

Chris Petrovic on Turkey:

Petrovic learned a lot about the Turkish market from the co-founder of Peak. A big plus for Turkey is being a crossroads of east and west. Deep heritage in gaming through traditional board games, and generally competitive culture

Attracting talent

Helsinki has a little bit of a challenge now that remote working is the norm and geographically it’s perhaps not as appealing as other places

High growth markets like Turkey should take the opportunity to invest in and improve working conditions, learning the lessons from places like China and Korea

Israeli competition for talent is “brutal” – you have to fight for talent aggressively, but everyone has this pragmatic view that “it’s just business”

Funding and investment

Finnish government matches the money you get from VCs, so the funding scene is healthy, but attracting talent is trickier now

Israel’s vgames plus a small but active angel community means the scene is buoyant – Playtika is investing, A and B round funding also attracting investors from outside of games

In Turkey, Petrovic says creating an ecosystem where everyone is investing in everyone else is the next evolution. Hopes industry can push the government to provide more funding for founders, and Turkey can become more global and less insular, learning from places like Helsinki. Turkey is uniquely placed to become an acquirer because it is literally where east meets west

Fireside chat: when launching a new game, focus on your process, not the game

Buğrahan Göker, EA; Sophie Vo, Voodoo; Maya Hofree, Product Madness

Market landscape

Vo started by stressing the importance of testing and failing fast, and validating every step of the way. Hofree agreed on the subject of speed when it comes to social casino – the market is rapidly changing so teams need to be as fast as possible in testing and making decisions. Both hypercasual and social casino markets can move on before your game gets to market.

Building teams

Vo says game teams need to understand that often their first game won’t be a hit – so she is interested more in people who enjoy the process of making games, rather than being attached to one particular game

Hofree has a similar mindset, in that teams need to be resilient and kill some games, and always react to what the market is telling them

Modern teams are not creating one game, they are creating the future of the company together, says Vo

Both Vo and Hofree see a lot of value in teams working together in person, especially when working on new ideas

Once games are up and running, successful remote working can work well, but studios will have to strike a balance

Failing fast

Vo says Plantopia had good metrics and a good business case, but ultimately didn’t fit with the studio’s long term view, so it moved into creating models where they can build and test very very quickly

Hofree also sees value not having to rebuild the same skeleton of a game each time, plus the need to be able to kill a game quickly, take those insights and constantly validate and test

Principles of game economy

Javier Barnes, King

Each different game audience needs a different economy. For example, keep it simple for an older player of a casual puzzle game versus a hardcore gamer who understands managing resources and more complex systems

Game economists must be careful to balance monetization techniques without blocking the fun. Battle Passes retain well, aren’t too aggressive but also monetize effectively, hence their popularity

Key principles of game economies:

Purpose: Consistently give players new resources and new uses for existing resources

Scarcity: Rewards have to be meaningful and goals have to be satisfying

Predictability and analysis: The simpler an economy is, the easier it is to analyze

Internal consistency: Focus in-game activities on features that foster engagement, retention, or monetization.

Control mechanisms: Add points in the economy you can control so you can rebalance the game more easily

Depth and expansion: Consider balancing both horizontal expansion (owning and collecting stuff) and vertical expansion (upgrading and adding system depth)

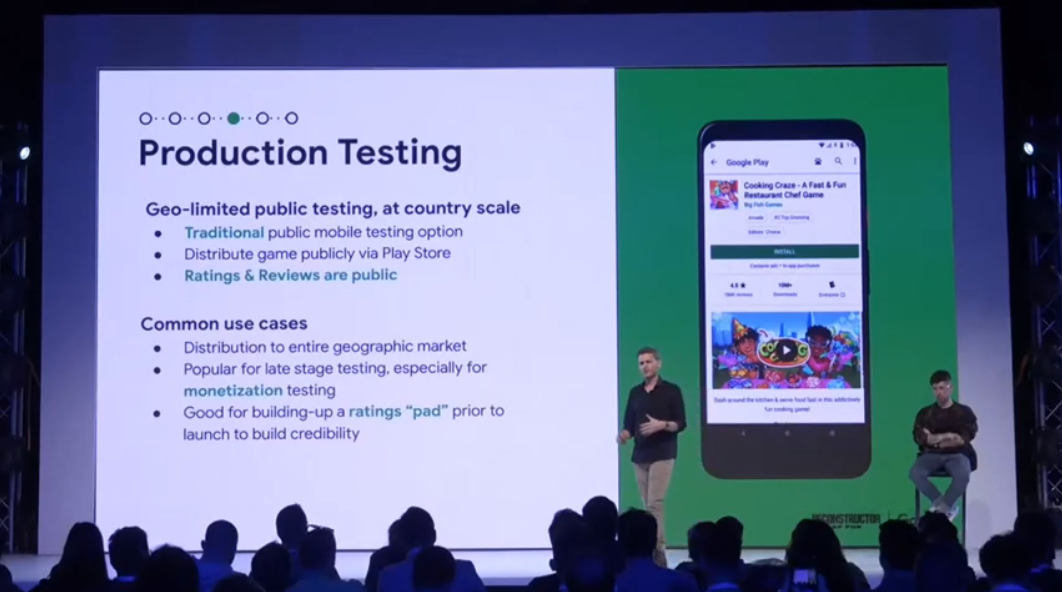

How to optimally soft launch a mobile game in 2022

Nimrod Levy, Google Play; Matej Lancaric, user acquisition consultant

Levy described a new era for pre-launching games in which developers engage in earlier external testing, open up more soft launch markets, and test retention over longer periods

He plugged Google’s Open Beta Testing and Production Testing programs, which allow developers to put their game out in specific regions and cap the number of installs

Levy emphasized that pre-reg games get a head-start on reviews and faster charting

On store listing optimization, Levy advised devs to include at least 3 landscape screenshots and a promo video of up to 30 seconds, because that’s what Google looks for when featuring

Levy also said that not enough developers are testing and optimizing store listings before the launch

He also urged developers to use Google’s managed publishing and stage rollout features to keep launches smooth and predictable

Just putting your game out in Canada and Australia is not the way to go anymore. Instead, you can ask Google’s team to calculate a market similarity index that uses geography, genre and monetization trends to identify the best soft launch market for your game

Matej Lancaric’s soft launch dos and don’ts:

Soft launch app store optimization can have a real impact, pushing conversion rates up significantly after some simple icon A/B testing

Developers should use at least three UA channels from Google, Facebook, Unity, Applovin, TikTok, IronSource, Twitter, and Liftoff, then benchmark them against each other

Think about UA strategy as it relates to the game’s genre. PvP games require most countries, UA channels, and continuous spending. Non-PVP games are naturally less demanding, and hypercasual games are fairly light in this regard.

Fireside chat: approaching P2E from a F2P background

Anton Backman, Play Ventures: Ryan Foo, Delphi Digital; Javier Barnes, King; Shafaf Bar-Geffen, COTI Group

Barnes questioned how developers extract value and income from a play to earn game – with F2P you get a cheque from Apple and Google at the end of the month, but with play to earn the developer proposition is a lot more complex.

Shahaf Bar-Geffen countered that the developer can get income from NFT sales, and that the game economy becomes self-fulfilling as its grows, so the developer can extract crypto and convert into ‘real’ FIAT money, with which you can play people’s wages over the long term.

Barnes also stated the difference between free-to-play, where the game developer has a direct economic relationship with the player, and crypto, where the game developer does not control player-to-player transactions. Losing that control and allowing players to regulate economies themselves could lead to problems and uncertainty.

Foo talked about decentralised development – the idea that player communities could, for example, make the game’s music and mint it as an NFT, or design game elements and mint those and see value added to their wallet. But solid examples of this happening were not clear.

Backman wrapped up by saying it is super early days in this space and play to earn was a blank slate right now for developers.

BONUS CONTENT Live Podcast: TWIG #176

Erick Kress, Eric Seufert, Michail Katkoff and special guest star Chris Petrovic from FunPlus

Sony’s new subscription package

Apple’s latest moves

McKinsey consultants in games

Hamam’s and Salt Bae…