Thetan Arena - The Mobile Game that Combines F2P and P2E

Deconstruction written by Ethan Levy and Javier Barnes. Opinions shared are personal and do not reflect those of their employers.

Don’t forget to subscribe to the Deconstructor of Fun podcast and YouTube channels.

Thetan Arena (TA) is a fascinating experiment in the burgeoning blockchain space. The Vietnamese developer WolfFun breathed new life into its top-down MOBA Heroes Strike by relaunching it with blockchain-based play-to-earn mechanics.

And importantly, unlike many of the (perhaps too early?) projects in the crypto space, Thetan Arena is a fun game and a well-rounded, complete product.

Though we (Javier Barnes - F2P Designer at King and Ethan Levy - Blockchain EP at N3TWORK) have differing opinions on blockchain games and whether they will revolutionize gaming, we both found Thetan Arena to be a fascinating case study for experienced F2P developers.

As many of our peers are considering shifting their games to P2E, the question everyone is asking is whether this new business model can create sustained success, or whether it’s just the latest hype-driven bubble set to burst.

Is Thetan Arena a better business than Heroes Strike?

JB: The mobile games industry is extremely competitive because of its low entry barrier, huge customer size, and short development cycles. Naturally, mobile game companies are in constant search of new blue spots in the red ocean to compete in. Not to mention the consequences of Apple’s IDFA deprecation, which has brought an even bigger motivation to explore new business models in the search for continuous growth.

As every day brings more news about massive fundraising rounds and eye-popping token valuations for blockchain games, it seems that crypto, NFTs, and play-to-earn are on every game dev's lips. But is this a viable and sustainable business model or just a fad? As a company, should you be considering making your next game play-to-earn?

Getting an answer is tricky.

For starters, most of the current games in that space barely feature any gameplay or are in an early work-in-progress stage, while sometimes also making unreasonable promises to their backers. And it’s not uncommon to see some of these projects end up in a rug pull.

This makes observers wonder if there’s any real player interest in this. Or if most of the money comes from the initial sales, and then it’s just players selling those assets to successive waves of folks that are attracted by the promise of getting rich. A hot potato game where somebody will end up crying. A quintessential pyramid scheme.

On the other hand, there are those who believe that all of this will change dramatically over the next decade and we will one day reminisce about these early, wild-west days of crypto gaming. The days when 98% of projects went to zero. Just like during the dot-com bubble in early 2000.

And secondly, the complexity of the revenue generation systems of its games makes the earnings of the developer companies way harder (sometimes impossible) to estimate. How much of this “revenue” is non-liquid magic internet money that can’t be transformed easily into actual cash, and is subject to massive value fluctuations?

Thetan Arena is an interesting case to study to shed light on these questions. It’s the play-to-earn version of a previously existing F2P game (Heroes Strike), which means that it has:

Fully finished gameplay at market standard levels of quality.

An IAP source of income that is unrelated to their blockchain revenue.

A years-long history as a standard free-to-play game that can be used as a benchmark.

Thetan Arena / Heroes Strike is a top-down shooter MOBA similar to Brawl Stars. The main differences are that character skills get upgraded during the match (a la League of Legends) and that 2 of the skills are selected from a list shared among all characters (which allows some OP combinations).

A concise summary of the system differences between Heroes Strike and Thetan Arena, courtesy of Ionut Dogaru and our friends at Mythical Games.

Heroes Strike vs Thetan Arena

In September 2018, the Vietnamese company WolfFun launched Heroes Strike, which has not exactly lit the top-grossing charts on fire.

Despite being a decent - albeit not too original - Brawl Stars clone, its low Revenue Per Download (~0.40$ on iOS) made it impossible to profitably grow Heroes Strike through User Acquisition. So it remained trapped in the lowest grossing positions without being able to scale, just like thousands of similar F2P games.

In August 2021, WolfFun announced that they would re-release Heroes Strike as a blockchain game under the name Thetan Arena. Similar to many other blockchain projects, Thetan Arena started out by raising money from early backers through an IDO (a bootstrapping method where a number of game tokens can be bought before the game launches).

This IDO happened just a month later in September 2021, and according to icodrops.com, WolfFun brought in ~$200.000USD to develop the game and provide liquidity.

Given how advanced the game was (especially compared to 99% of the blockchain games out there, most of which were vaporware), Thetan Arena quickly attracted a lot of attention, first within the massive Vietnamese blockchain community and later worldwide.

But it’s not only that the folks at WolfFun had a good hand, they also played it very well. By listing their token in multiple exchanges and collaborating with some of the biggest actors in the space, they built a huge game community and amassed even more funds.

Thetan Arena quickly brought a lot of attention in the blockchain space because it was a project in an advanced development stage and WolfFun skillfully achieved collaborations with key actors.

Fast forward to November 2021 and the game launches worldwide in iOS/Android, amassing 10 million downloads during the first two months. This is a massive improvement from its previous iteration as Heroes Strike.

It’s evident that Thetan Arena has been a massive success for WolfFun: simply taking into consideration in-app purchases, like I would with any other mobile game, Thetan Arena has generated more revenue and achieved more downloads in two months than Heroes Strike in all of its lifetime.

To put this into context, this means that the game is making ~$20k per day. Which is a great haul for a small studio, but far from the top-grossing chart positions.

How Crypto Boosted Thetan Arena’s IAP Revenue

Interestingly, when looking at the Revenue Per Download (RPD) numbers, there’s little difference between both games.

So it seems that, while Thetan Arena has been able to reach a much bigger audience through the P2E unique selling point, when it comes to IAP it hasn’t been able to monetize them better. (Obviously, overall they are monetizing better when taking into account the extra revenue obtained through the blockchain, which I estimate later on in the article).

The fact that the game doesn’t make more IAP per player is surprising if we take into account that they took out important vectors of the monetization like character and skill unlocks.

The monetization of those areas happens outside of the mobile game client. Thetan Arena complies with AppStore and GooglePlay guidelines by disconnecting blockchain from the client. The two stores don’t outright ban blockchain games, but have several guidelines that make them difficult to operate.

Thetan Arena’s solution is to remove all blockchain interactions and mentions from the mobile game client. Players cannot acquire or trade NFT characters, nor can they transfer game cryptocurrencies to their wallets. All blockchain interactions are managed through an external website. So within the walls of the mobile app, it’s a “non-blockchain experience”. If you downloaded Thetan Arena without knowing it was a blockchain game, you wouldn’t be able to figure it out just by playing it on your mobile device.

Of course, while this doesn’t infringe store guidelines, this feels like a loophole and there’s a risk that an update to the guidelines will make this approach unviable.

Players can only acquire and trade NFTs and send game currencies through an external website, which allows the app to comply with store guidelines.

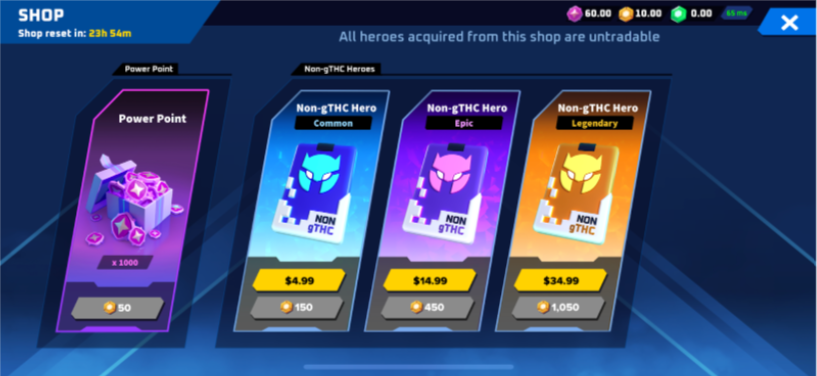

Through regular IAPs, players can buy several things that are not blockchain-based and don’t foster play-to-earn: loot boxes that grant non-NFT characters (that can’t be traded and don’t generate additional cryptocurrencies as rewards) and character skins.

In-app purchases only allow buying elements that can’t be used for play-to-earn, such as characters that grant no THC acquisition bonuses and cosmetics.

P2E Games Attract a Specific Country Mix

Another relevant factor that’s worth highlighting regarding the reach and revenue is the country mix: ~60% of the downloads come from Brazil, the Philippines, and Indonesia.

This data is in line with other p2e games such as Axie Infinity, where such countries account for a massive percentage of the playerbase.

And ultimately, it reinforces the idea that p2e games have a huge attraction in countries where the small p2e rewards have meaningful purchasing power, and not as much organic pull in rich ones where the p2e income would not make a large difference in a player’s finances.

Historically, this fact has been used to argue that most p2e players don’t care about the gameplay, only about making money.

Interestingly, IAP data shows that several of these countries have a bigger relative weight on IAP revenue compared to their volume of downloads. The most evident example is Brazil, where despite counting for 29% of the downloads, it generates 39% of the in-app purchase revenue.

Since in-app purchases in Thetan Arena are not related to play-to-earn, this hints that although players may have come for the p2e rewards, at least some of them have made traditional IAP purchases for gacha heroes and cosmetics.

Estimating Thetan Arena’s Blockchain Revenue

To understand if Thetan Arena is a successful business, it’s not enough to know how much WolfFun has made on IAP, but also the revenue they’ve made via blockchain.

I’ve put the effort to estimate their blockchain revenue and yes, Thetan Arena has made more revenue through blockchain than through IAP.

Keep in mind that the concept of “revenue made in the blockchain” is tricky. That revenue is less liquid than the fiat obtained through regular IAPs: The value of cryptocurrencies fluctuates wildly over time, and transforming them into fiat may have additional costs (fees, taxes…).

This is even more problematic when the currency obtained is in the game’s native tokens (THC and THG), since a developer can lower the fiat value of their cryptocurrency by selling too much of it into the marketplace at once, and even trigger rug pull alerts among players.

In my view, realistically we should only consider as income the BNB collected, not the game native tokens since the amount of BNB owned by WolfFun is not enough to affect the coin’s market cap. In which case, they still made two-thirds of their revenue through blockchain.

(EL: I disagree here. THC and THG are still a source of potential revenue, and learning how to manage your token treasury and turn it into fiat currency responsibly is a skill that we will all be learning as we adapt to this new world of crypto gaming).

Estimation methodology:

WolfFun gets two main sources of “blockchain income”: Marketplace fees obtained from transactions of Heroes and the income from Loot Box purchases. The methodology that I’ve used to get the data on each is different.

To know marketplace fees I used a service called Dune Analytics, which allows performing SQL queries on a database synched with blockchains. [BNB Fees] [THC Fees] (marketplace fees recently switched from WBNB to THC)

To know the income from selling boxes, I used BscScan to track the wallet that receives the payments (which I got from the smart contract). [THC collected] [THG collected]

The estimations exclude amounts raised through the successive token listing in exchanges or from early NFT sales before the release of the game.

Finally, for calculating the equivalence to dollars, I’ve taken the average price of those currencies on the 13/Feb/2022.

This is as far as exposing game performance data goes. Now, to understand the player experience of playing Thetan Arena for profit, I leave you with DoF resident blockchain expert, Ethan Levy.

Buying Thetan Arena NFTs is a money-losing proposition

EL: First of all, wow, amazing work by data detective Javi in estimating Thetan Arena’s blockchain revenue. I expect we’ll see that revenue estimate image in conference presentations for years to come.

For my half of the article I wanted to understand how Thetan Arena’s play-to-earn mechanics worked and if, as a player, it made any sense to shell out the exorbitant prices being charged for NFTs on the marketplace. Spoiler alert… spending $500+ on a hero NFT is a terrible idea in this game. Or I’m a terrible player. Or both…

It’s probably both…

Acquiring An NFT Hero

Thetan Arena operates openly on the App and Play Stores. As a result, there are two paths to get heroes depending on whether you want to engage in the token economy:

Buy a premium hero in the mobile client as an IAP. With this option, your heroes cannot earn tokens through daily play.

Buy a premium hero on the web marketplace. With this option, your heroes are NFTs and can earn tokens from a limited number of matches each day.

If you’re interested in an NFT, you have two options. You can buy a gacha pack in the form of 3 different rarity chests with prices ranging from ~$150 to ~$5000 dollars. Or you can buy a specific hero in the marketplace from another player. At the time of writing, these NFT heroes range from $20 to $5,000.

When buying on the marketplace, an NFT may be new or used. If used, that means some of its total available token battles have been depleted. I’ll explain this more alongside daily limits below.

Daily/Lifetime Limits

The developers of Thetan Arena made some interesting choices to cap the earn rate of NFT heroes:

An NFT has a lifetime limit of total token matches. For example, a Legendary Kong Key may have a limit of 810 matches.

An NFT can only play a limited number of token matches per day. For the first N matches of the day, the hero is eligible to earn tokens. Any matches after that are just for fun.

These are interesting choices but in my opinion not successful ones. With the lifetime limit, they have capped the total potential earn rate of an NFT. This way even if you have a hero you dominate with, you will eventually need to buy a new one. But the way I play? There’s no way to make a profit.

With the daily limit, they have set a cap of the potential earn-out per NFT per day. With my Kong Key example, the first 12 matches of the day are for gTHC and the rest are just for fun.

I expect there were two main motivations here:

Motivate you to purchase more than one NFT in your lifetime.

Motivate you to own a stable of NFTs, so you can play for tokens during the whole day.

Neither of these design choices was successful in my opinion. Instead, they made it simple for a player like me to do some math and determine “it will take me 48 days of play to use all these token matches, and in the process, I will certainly lose money.”

When combined with an IAP path to the same heroes, buying a $35 premium hero is much more attractive than a $500 NFT.

EL: I wanted to find out what my earning potential was for Thetan Arena. But since NFTs had a capped value (due to the lifetime limit) they did not seem like a worthwhile purchase when compared to a game like Crypto Raiders (where my NFT’s value does not degrade with use). So I decided to simulate playing on-chain by proxying with an IAP hero from the Legendary tier gacha box.

ET: I pulled a Kong Key, which was a Legendary hero equivalent to this $575 NFT from the marketplace. Had I purchased this hero, I would have gotten the best possible gTHC bonuses when winning matches. Using all my token matches per day, I would have had about 44 days of play at a cost of $1.09 per token match before my NFT lost all earning potential and therefore all resale value.

There are a few factors determining how much gTHC you can win from battles: game mode, final position, and NFT rarity tier. In addition to the rewards specified in the table above, you also get a bonus based on your NFT’s rarity:

To simulate the experience of playing for tokens, I played 24 total matches with Kong Key, representing 2 days of play. Assuming I wouldn’t get meaningfully better over time (or the matchmaking algorithm would keep my victory rate fairly constant), I would have earned tokens 54% of the time and scored the 23.55 gTHC victory bonus 33% of the time. I would have averaged an earn rate of 9.38 gTHC per match.

When I did the research, the value of gTHC was $0.05151. So at that price, I would have won $0.483 per match. But given that the NFT would never have any residual value after all its battles were used up, my cost per match was $1.09.

Given my skill level and token prices at the time of writing, I would have lost $0.61 each time I played and been left with a worthless NFT at the end of the process. And that’s ignoring any gas fees I may have incurred along the way.

If you are a much better player than me, you could make a slight profit playing Thetan Arena. But given the daily rate limits and currently low token prices, it does not seem like a very good use of time.

Proposed Changes

I think Thetan has made some interesting choices in the likely pursuit of longer-term economic stability. But based on this analysis (and the downward trending value of the THC token) I do not think these choices have been very successful. Without going too deep, there are two changes I would think to make to bring more stability to the economy and long term value potential to the players:

Give NFTs a daily limit but no lifetime limit. Say 1 token match per day. This way the value of an NFT never goes to 0 from overuse, and the player is encouraged to own multiple NFTs.

Cap the supply of NFT heroes released into the world. Anything like breeding or uncapped gacha that can generate an infinite supply of NFTs is more likely than not to result in oversupply, therefore devaluing those NFTs.

These changes are likely easier for an in-development game to make than one that is already live and played by millions. Overall I think there is a lot to learn from Thetan Arena and they have done an admirable job of innovating their tokenomics model as opposed to just copying Axie. However, I do not feel like this game has cracked the nut when it comes to architecting a long-term, sustainable token economy.

Conclusions & Takeaways

Javi’s Takeaways:

Through the play-to-earn premise, Thetan Arena has attracted a significant number of downloads.

About 60% of them come from Brazil, the Philippines, and Indonesia, which points out interest in these games is bigger in low-income countries than in high-income countries like the US.

This is interesting because perhaps this new model could successfully target audiences that have generally been overlooked by the usual F2P model, which is dolphin and whale oriented (even in their local variants).

We estimate that during the first two months since launch, Thetan Arena has generated about $3M dollars in revenue. This is far from top-grossing positions in the stores, but an impressive increment considering the performance of the original game.

About 30% of that is actual cash generated through regular in-app purchases (unrelated to play-to-earn), and 70% is in BNB collected as marketplace fees and box purchases.

While the game has been extremely successful for the developers at WolfFun, I consider it a missed opportunity because it faces sustainability issues.

Their implementation of p2e has key problems (no clear usage for THC, simplification of the internal game economy, and the removal of many vectors of monetization, developer-sold boxes competing with player-sold heroes in the marketplace…), which will require significant changes to make the game sustainable on the long term.

The shift towards competition-based earning (based on Ethan Levy’s experience, only players with an excellent win ratio will get earnings) is an interesting concept but ultimately makes purchasing the NFTs somewhat like gambling, which doesn’t incentivize trading. In the current proposition, it’s only WolfFun who always wins, not players who have to play extremely well to get their money back.

Ethan’s Takeaways:

Thetan Arena succeeds in being a fun game but fails to architect a long-term sustainable token economy.

Thetan Arena’s design choices make it easy for a player to realize that playing is not profitable based on high NFT prices and low token prices.

Ethan is not very skilled at Thetan Arena 😭

Though an interesting experiment, and one that has certainly turned a F2P underperformer into a meaningful P2E revenue generator for WolfFun, Thetan Arena is a great case to learn from but not a fully realized template for how gamedevs can reinvent their mobile underperformers as crypto game hits.

Disclaimer

Blockchain games and NFTs are very divisive topics that can lead to intense discussions. In some cases, the only thing that opposed points of view have in common is not presenting actual data to justify their assessments.

We hope that readers understand that our purpose is not to persuade them of our own points of view (the authors do in fact have different stances on blockchain and p2e), but rather an attempt to expose information in the most objective way possible so that readers can reach their own conclusions. We encourage you to share your take in the comments in a civil manner. And if you have to drag anyone all over the internet… drag Ethan “The Crypto Kid” Levy 😘