2022 Predictions #4 Casino Games Brace for Impact

This prediction is written by Michail Katkoff and in co-operation with the powerful analysts at Sensor Tower.

Access all previous predictions here. And don’t forget to sign up for our newsletter!

This report wouldn’t be possible without the help from our friends at Sensor Tower. An essential data platform for all mobile gaming studios.

Data from China, Korea, and Japan are excluded as this analysis focuses on Western markets only. Please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise of accuracy.

In 2020 Casino games revenue grew by 47% while installations soared by over 60%. As people were locked down and real-life casinos shut down, casino games on mobile made bank.

2021 was a much different year. The growth of revenues was only 9%, while the downloads declined by 20% as lockdowns eased and privacy changes were enforced on iOS.

Casino genre revenues have consistently increased for the past three years and total revenues of Casino titles crossed $5.5 billion in 2021, a year-on-year increase of 9%. At the same time, downloads declined to 615 million in 2021, a year-on-year decrease of 22% after peaking in November 2020.

The Covid outbreak led to a dramatic increase in revenues and downloads of top Casino games, which continued through November 2020. While revenues remain high and have not yet normalized to pre-Covid numbers, downloads dropped significantly in 2021.

Coin Master is the top performer among all Casino games. In 2021 alone, Coin Master generated $951 million in revenue, more than 3x second place Slotomania and had 54 million downloads, more than 2x of second place (again Slotomania).

Playtika and Moon Active were the top publishers of Casino titles in 2020 and 2021 in terms of both revenue and downloads. Most Casino publishers have multiple titles in their portfolio, including several Slot games.

Downloads peaked for all categories in 2020, but 2021 download totals still outpaced 2019 substantially.

The Casino category saw the largest drop-off in downloads between 2020 and 2021 (-23%). However, 2021 download totals were still 28% higher than in 2019.

Total downloads across all Categories saw a +15% 3Y CAGR from 2018 to 2021 (with a 28% 2Y CAGR between 2018 and 2020, when downloads peaked).

Downloads of the top 100 Casino titles grew from 485M in 2018 to 791M in 2020, before decreasing to 612M in 2021.

Following download peaks for all game categories in 2020, revenues continued to grow across all categories in 2021. The Casino category saw a +27% 3Y CAGR since 2018, including a 9% increase between 2020 and 2021.

The highest year on year revenue increase for all game genres occurred in 2020.

The Casino category has the highest Compound Annual Growth Rate (27%) from 2018 to 2021, followed by Casual (20%) and Mid-Core (19%).

Revenues of the top 100 Casino titles grew from $2.7B in 2018 to $4.7B in 2021. In 2020, the Casino genre had the largest year-on-year revenue increase (46%), followed by the Casual genre (32%).

Casino on Mobile

Trends, Demographics, Audience, and IPs

The pandemic favored the Casino category. New players flowed in and revenue grew. The drop of downloads will most likely lead to declining revenue in 2022.

Aggregate revenues of all Casino sub-genres increased over the last 4 years. Revenues of the Social Casino sub-genre significantly increased due to Coin Master’s success beginning in 2019.

Coin Master’s revenues accounted for 90% of total revenues of Top 25 Social Casino games in 2020 and 93% of total revenues in 2021. Highest year-over-year revenue increase for all game genres occurred in 2020. After Social Casino, the Bingo sub-genre had the highest CAGR from 2018 to 2021.

Casino games saw an unprecedented growth in downloads when real-life casinos closed during the pandemic. Even in countries that don’t have Casinos (e.g. Brazil), staying at home drove demand for casino games on mobile nevertheless. When the lockdowns eased and privacy changes by Apple took effect, downloads in the category declined to pre-pandemic levels.

Downloads of all Casino sub-genres peaked in 2020 before declining in 2021. Similar to the revenue trend, downloads of Social Casino games significantly increased due to Coin Master’s success and more titles released after 2017.

The highest year-over-year download increase occurred in 2020. That’s when more people turned to casino games on mobile as the real-life casinos closed down.

Two very unique Israeli publishers, Playtika and Moon Active dominate the top. Playtika is a public corporation known as a top operator. They have a strong portfolio of several top Casino franchises in key Casino sub-genres. Moon Active on the other hand is known for Coin Master, which alone generates more than the whole Playtika Casino portfolio. Both publishers are actively and successfully expanding into casual games through M&A.

Playtika and Moon Active dominate the category in both downloads and revenue. Outside of these two publishers, only two other publishers were in the top 10 in both downloads and revenue (SpinX and Zynga).

Of the top-grossing publishers, Moon Active is the only publisher with one title (Coin Master). Their second title is Pet Master, which has been in soft launch since 2020 and launched in Great Britain in 2021. Other publishers have multiple titles in their portfolio, often including several Slot games. Zynga and Playtika have diversified their portfolio beyond Slot games with Zynga Poker - Texas Hold'em, and Playtika’s Bingo Blitz and World Series of Poker.

Tencent’s card titles Happy Landlords and Happy Mahjong are very popular in China.

Casino games live or die based on their success in the US.

The US is the top-grossing market for Casino games, generating nearly 60% of all category revenues. All of the top 10 Casino titles by revenue generate their highest revenue share from the US.

The most downloaded titles in the US are Social Casino and Poker/Card games. Card games are very popular in Asian countries like India. 5 of the top 10 downloaded games have the most downloads from India, China, or Indonesia. In India, Teen Patti, Rummy, and trick-taking card games are popular. In China, Golden HoYeah is a popular Slots game. Card games like Dou Dizhu are also popular in China, such as Tencent’s Dou Dizhu game called Happy Landlords.

Just like in real-life casinos, IPs play a significant role in attracting players.

Just like in mid-core games, IP games are popular among top publishers in the Casino category. Top Casino title publishers like Playtika, Zynga, and Scientific Games have all used popular IPs such as ‘Wizard of Oz’, ‘Monopoly’ and ‘Game of Thrones’ in their Casino games.

IP games are usually Slot games, which is in line with the real-life casinos. Only a handful of top Bingo and Poker/Card games are based on licensed IP.

Demographic data of top Casino titles indicate the following:

Poker / Cards have a higher male user base and a relatively younger average age of players.

Slots games have a higher female user base and an older population of players as the average age is high and the percentage of players below the age of 25 is very low.

Bingo games have the highest female user base among Casino titles. The average age is relatively older (+35) and the number of users below age 25 is low. Social Casino games have the most stable demographic data, with near equal splits of male and female users as well as a younger user base.

Bingo rounds take more time than spins in slot machines. That's why it is common to have high session durations.

Top Social Casino games like Coin Master and Pirate Kings have higher retention rates (Day 1, Day 7, Day 30) compared to games from other Casino sub-genres.

Poker / Card Games have a longer average session length and a large portion of users play for more than 10 minutes per session. Slots games have lower session durations but a very high number of sessions. Bingo games have high session durations but a very low number of sessions.

Social Casino games are similar to Slots with a low length of sessions but a high number of sessions.

Casino Genres and Publishers

Slots, Cards, Bingo, and Social Casino

Slots are the biggest sub-genre in Casino. In 2021 the net revenues for Slot games grew 4% reaching nearly $3.1B. During the same period, installs declined by 8%.

As a whole, Slot games have experienced significant growth over the pandemic. Total monthly revenues of Top 200 Slot games increased by 62% from $175M in Jan 2019 to $284M in Dec 2021. Revenues peaked in May 2020 ($307M). Total monthly downloads of the top 200 Slot games increased by 32% from 16M in Jan 2019 to 21M in Dec 2020, before declining to 15M in Dec 2021.

The top 5 publishers captured a 60% market share of the total revenue of the top 200 Slot games from 2020 to 2021. Top publishers have multiple Slot titles in portfolios (usually 3 or more) and each title brings in significant revenue. In that sense, Slots is very much like the 4X category on mobile. Even the retention profiles look somewhat similar.

Aristocrat and Playtika have a large lead in revenues. While Aristocrat earns substantial revenues from all of its Slot games (Cashman Casino, Heart of Vegas, Lightning Link), Playtika earns a large portion of revenues (~55%) from one game, Slotomania.

SpinX’s Cash Frenzy features popular slots and high-limit machines from Vegas casinos, as well as progressive jackpots and bonus games. New slot games are added on a weekly basis.

At the same time, the largest Slot game in the market, Playtika’s Slotomania, was also the game that declined the most - losing 22%, which accounts for $70M. What makes this decline worrisome is that Slotomania’s YoY downloads were actually up by a whopping 70%. This amount of growth in players should be visible in the revenues of an extremely well monetizing game like Slotomania. And the fact that it isn’t is quite worrisome for the king of Slots.

The US is the most popular market for most top Slots titles. One exception is Golden HoYeah which is most successful in China and led the download rankings for all Slots games globally since January 2019, clocking 41M downloads.

Poker and Card games grew revenues by 17% YoY. Playtika’s WSOP and Zynga Poker continue to dominate the sub-genre though growing at below the market rate. At the same time, games likeTexas Hold'em Poker and Poker Atrix grew significantly faster. And there were few poker games that scaled up as well. Games like Spades Royale, Holdem or Foldem, Mega Hit Poker. Overall, in terms of revenue, nearly every poker game in top 20 grew during 2021.

Downloads for poker games went down 13% YoY. Most noticeably, Zynga Poker downloads were down a whopping 60%. This had an effect on the overall downloads of the sub-genre. Holdem or Foldem and two Teen Patti games scaled up last year. But overall, there were more games losing downloads than growing them.

In terms of geographics, US and China are the highest-grossing market for Poker / Cards titles while India, China, and Indonesia lead in downloads. Despite a considerable amount of installs, neither Indonesia nor India generate substantial revenue (<2% share each) from in-app purchases.

Regional games like Teen Patti in India and Landlord in China drive high download shares in those markets, while Poker titles drive the US market.

All top-10 titles grew significantly over the past two years. Yet the growth outside the top-2 was far more significant.

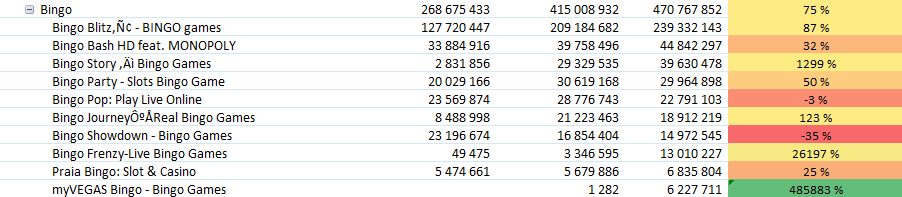

Bingo games as a whole grew 13% in terms of overall revenues and achieved 17% more downloads last year than the year before.

Bingo Blitz dominates this sub-genre. In the last two years, it generated $449M in revenue and 18M downloads. This is nearly half of all sub-genre revenues. Bingo Story, Bingo Frenzy, and myVegas saw also considerable growth in downloads and revenue last year.

Bingo Clash is a bit of a standout in the sub-genre. The game scaled up in terms of downloads but shows no IAP revenues. The game clearly relies on somewhat innovative monetization methods that require more investigation.

Seeing considerable growth is rare in the very mature Bingo sub-genre. Nevertheless, last year we witnessed the scaling up of myVegas Bingo and Bingo Clash. Overall, the whole sub-genre got 17% more downloads last year than the year before.

The US is the most popular country for top Bingo games in terms of both revenue and downloads.

The growth of the Bingo genre has been very impressive over the last two years with both top titles and new entrants scaling up. Unlike in Poker, a couple of Bingo titles declined during the genre’s growth spurt.

Coin Master dominates this sub-genre capturing 94% of total revenues of all Social Casino games. Of its $2.3B lifetime revenue, Coin Master earned the majority ($1.8B) in the last two years. Coin Master accounted for less than 50% of total Social Casino downloads in the same period, making their revenue dominance particularly impressive.

Coin Master’s monthly revenues more than doubled during the period, from $43M in Jan 2020 to $91M in Dec 2021. Most revenue growth occurred in 2020. Revenues have not yet normalized and continue to remain high, driven by the pandemic.

Playtika’s Pirate Kings trails Coin Master and has similar mechanics but uses a Wheel of Fortune instead of a slot machine. The US is the most popular country for top Social Casino games in terms of both revenue and downloads.

Social Casino is as concentrated of a genre as there can be with Coin Master taking nearly all of the revenues. During the years we’ve seen competitors attempting to scale up only to tumble down the following year. The best success is seen with games like Board Kings (Playtika). These games use the Coin Master loop but with a different core.

Coin Master loop

Coin Master disrupts the traditional Slots core loop of Spin + Collect coins by adding mechanics of raiding player villages and building/upgrading villages. The best way to describe this game is Clash of Clans meets a slot machine.

In other words, the game monetizes by making players anxious. Your goal as a player is to collect enough coins to build the next building. What drives the anxiety is that other players will try to steal your coins that you’ve worked so hard to collect. And you’re doing the same thing to them too.

Another big difference to Clash of Clans-style village building is that in Coin Master, players’ villages are not persistent. Instead, there’s a world map with 260+ levels and players progress to the next level after using coins to complete a village. This approach fits better with the predominantly female target audience that is very familiar with saga-based puzzle games. It’s also a way to provide the feeling of progression. Unlike in Clash of Clans, you’re not stuck for months upgrading your one town hall to unlock new building levels.

The game adds another collection mechanic via pets that are obtained through chests. Completing card collections is important as pets provide increased raid rewards, protection from raids, etc.

The game heavily promotes social features. Rewards can be obtained for linking to one’s Facebook account, posts, following Coin Master’s Twitter account, etc. Coin Master also has an official Facebook group for players to meet & trade cards.

Casino faces serious uncertainties

The Social Casino genre saw major unexpected growth in 2020 and the first part of 2021 due in large part to COVID social distancing measures. However, this growth did little to address some of the underlying challenges facing Casino apps — most notably, an ever-growing number of apps competing for a plateauing user base.

In 2021, we expected to see accelerated cycles of innovation and fast-follow as smaller publishers reached for new players and established publishers tried to hold onto their territory. During the last two years, we only saw 60 new titles being released (23 Slot games, 16 Social Casino games, 15 Poker / Card games, and 6 Bingo games).

To some extent, this trend occurred. We saw games like Holdem or Foldem, Gin Rummy Stars, Poker Face, Pet Master, Jackpot World, Cash Tornado, and Cash Frenzy experiencing triple-digit growth over the two years. And while we saw Slotomania decline under the pressures of market evolution, the top titles in Poker, Bingo, and Social Casino all grew — albeit that in Poker the growth of top titles was slower than the overall growth of the sub-genre.

We expect that additional outside influences — like increased investments and new markets for real-money gaming — will create even greater pressure. The biggest impact on the future of the genre will nevertheless continue to come from IDFA depreciation. As we predicted last year, the impact of privacy changes didn’t cause a sweeping change. Instead, the effect was gradual as the changes weren’t enforced off the gate.

Casino games on mobile are excellent at retaining and monetizing their audience not only via fantastic design and optimization but also due to unrivaled CRM, compared to other genres. This will allow them to hold on to their existing player base. The lack of advertiser identifiers will nevertheless significantly harm new user acquisition, making it nearly impossible for new mobile-first titles to burst through, thereby causing the market to slowly but surely decline on mobile — assuming a black swan event doesn’t significantly alter downloads.

2022 Prediction #1: Attack of the Master Clones continues

Throughout the last couple of years, we saw Coin Master look-a-likes entering the market and new concepts taking the stage with variations to the Slots core and presumably more marketable visuals. It is very unlikely that any other game will challenge Coin Master. Even Pet Master from the same company is far from a guaranteed success.

Our prediction is that Coin Master will remain something like Clash of Clans — a massive genre-defining hit that will never be challenged nor out-muscled in the genre it created.

2022 Predictions #2: Minigames, Collections, and Visual Progress

Casino Games will continue to integrate features that are designed to appeal to players from other genres, particularly puzzle and casual. These features include the likes of explorable hub worlds, homes, and other custom design areas. Overall, we can expect Casino Games to be somewhat of an incubator for a puzzle or skill-based mini-games. Mini-games often take place of reward collection stages, which occur after a player has engaged with the actual Casino Games.

2022 Predictions #3: Wide Appeal becomes essential

With privacy changes being enforced in 2021, the ability to effectively target players has diminished. That means trouble for casino games, that have relied on performance marketing to attract and re-engage the whale players. IPs and celebrities have already been utilized by casino companies and we will see more of that taking place in 2022.

2022 Predictions #4: Diversify or Die

Casino game companies are world-class operators. Their ability to grow players’ LTV through data, community management and cross-promotion is unrivaled by other genres on mobile. Yet, cut-throat competition combined with privacy changes that restrict efficient user acquisition presents a brutal combination that has halved the stock price of some of the best companies in the category.

To survive the onslaught, we will see Casino companies diversifying their portfolios through acquisitions of casual game companies with audience affinity and games that have great long-term retention profiles. These are games to which Casino companies can add value through optimization.