How Call of Duty Mobile left $100M on the Table

This analysis is written by Adam Telfer, Om Tandon and Nate Ross

Psst! Make sure you don’t miss on all of the 🔥content coming out in the future, please do subscribe to the Deconstructor of Fun infrequent but powerful newsletter.

AAA game franchises are in the middle of a renaissance on mobile. Several of the industry’s top IPs have received high-fidelity ports that have been successful in bringing core franchise players to the mobile format. Major franchises claimed three of the top downloaded title spots worldwide last month: Call of Duty Mobile, Mario Kart Tour, and PUBG Mobile.

Call of Duty is a penultimate franchise in the shooter genre. The Call of Duty series began with the original Call of Duty on PC and console in 2003 and has released one title every year since. The most recent installment, Call of Duty: Modern Warfare, made over $600 million in three days.

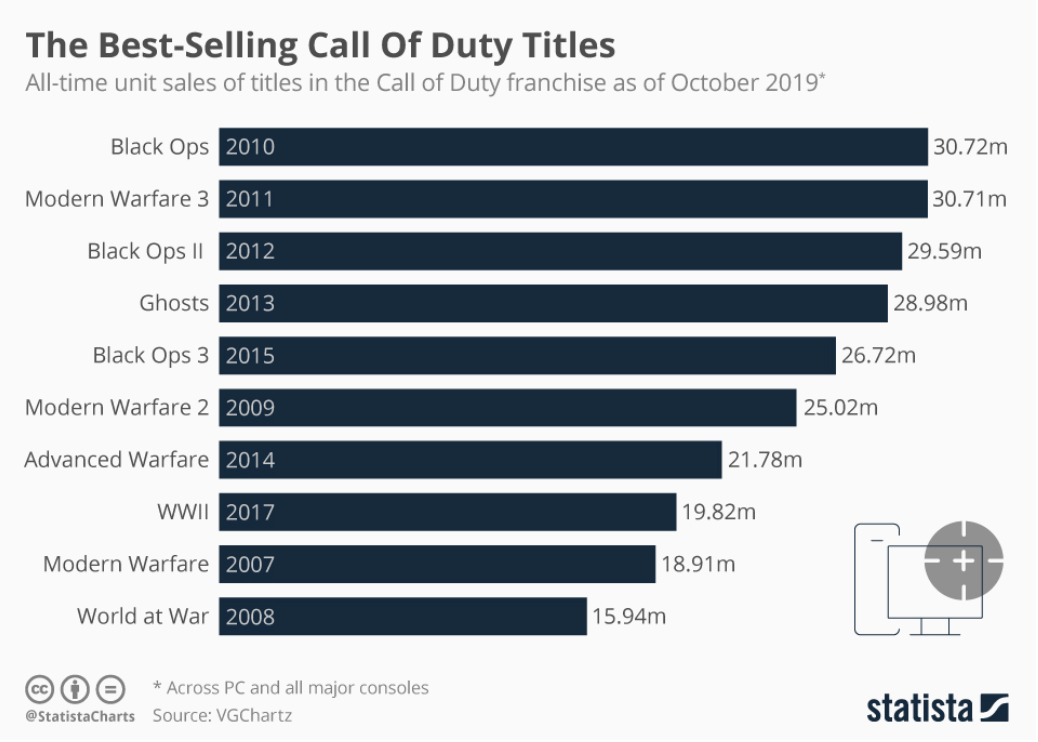

Call of Duty franchise titles routinely sell millions of units every year.

It was only a matter of time before Call of Duty would find its feet on mobile. Call of Duty Mobile launched on Android and iOS on October 1st, 2019 and racked up a record-breaking 100 million downloads in its first week and 148 million downloads in its first month (beaten only by Pokemon Go). This is a staggering number and one that all mobile designers should take note of.

The power of PC/console brands can not be underestimated on mobile. These games have a huge leg up in terms of organic downloads. Repeating from the launches we’ve seen from Fortnite, Mario Kart, and Pokemon Go, these massive brands have the potential to shake up the Top Grossing Charts.

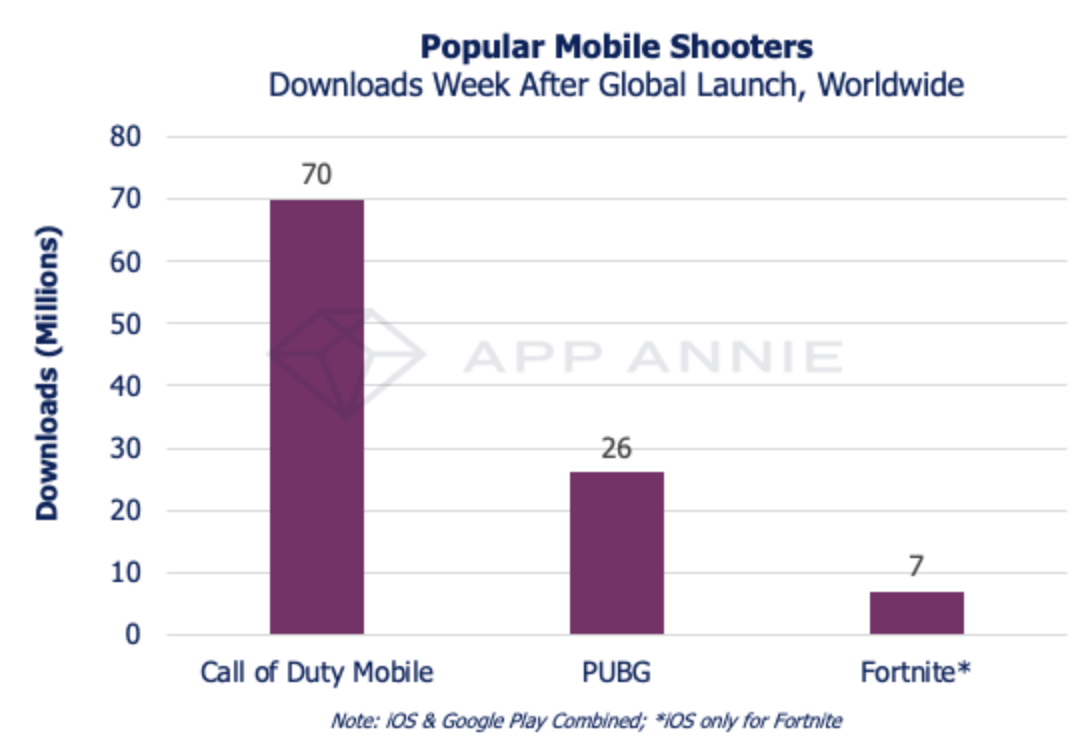

First week after global launch:

- Call of Duty Mobile (October 1-7, 2019): 70M downloads

- PUBG MOBILE (March 18-24, 2018): 26M downloads

- Fortnite (iOS only, March 15-21, 2018): 7M downloads

*Worldwide data excludes China android

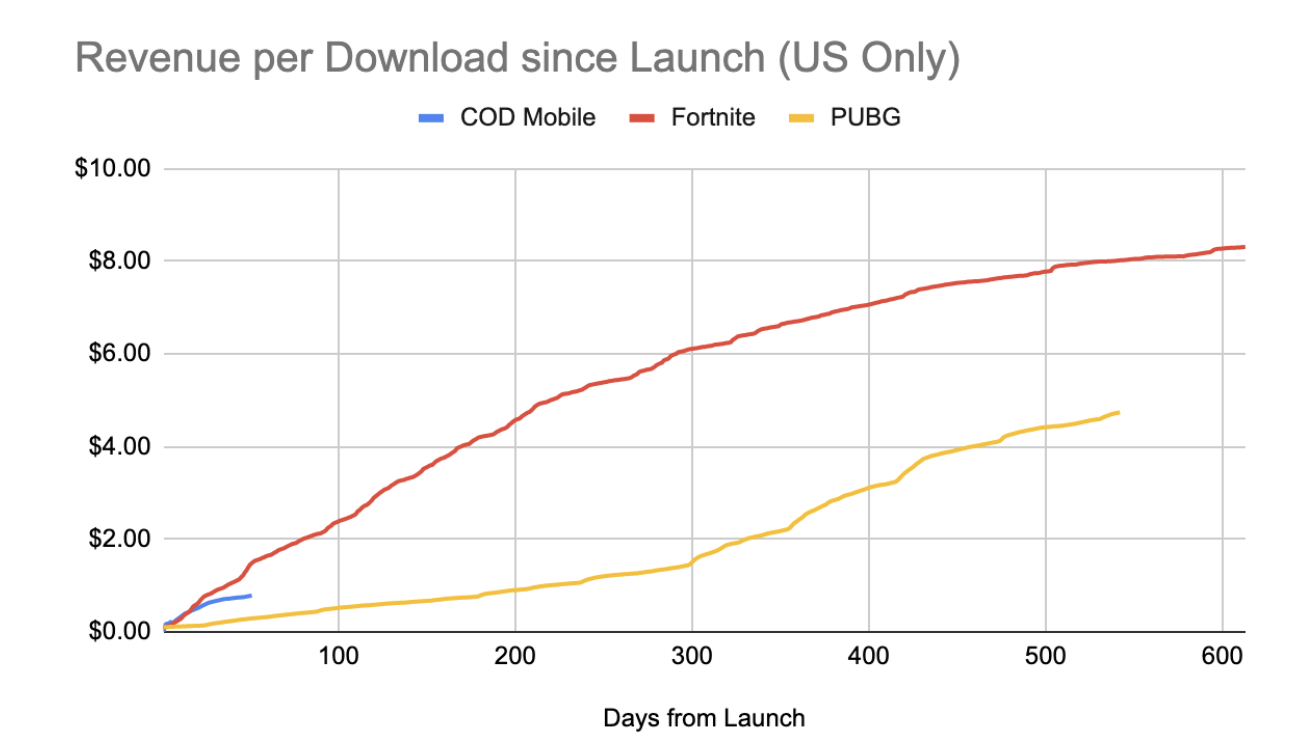

However, it isn’t all positive: While Call of Duty Mobile has performed exceptionally well from a download and retention standpoint, the game has shown relatively low revenue per install (RPI) compared to its biggest competitor (and fellow Tencent-developed title) PUBG Mobile. PUBG Mobile serves as a perfect comparison point for Call of Duty Mobile due to its similar gameplay and monetization framework.

Five days into its launch, the title's US daily revenue peaked at just over $2 million per day. Now 30 days into launch, that number has decayed to just over $800k per day. When aligned by launch, we can see that Call of Duty’s revenue-per-download performed comparably with PUBG. Yet -- PUBG’s net revenue was practically non-existent until 10 weeks post-launch -- when they introduced the game’s first battle pass, and didn’t reach $1 until nearly 8 months post-launch.

Call of Duty Mobile’s RPI is likely going to grow slowly - it took PUBG 8 months to get to $1

In summary, Call of Duty Mobile has had tremendous success with attracting and retaining players but has faltered with monetization out of the gate. The game’s RPI curve has flattened only a little over a month post-launch. So is COD Mobile dead? Can it ever monetize? Or will it turnaround?

To understand that, you have to understand the developers of Call of Duty.

The Long and Winding Road to COD: Mobile’s Launch

To tell the story of Call of Duty Mobile, you have to start all the way back in 2008. At that time, Shenzhen-based Jade Studios created a massively multiplayer PC racing title for the Chinese market called QQ Speed. The title became immensely popular (it still is today) and put Jade on the map. QQ Speed was followed up by an MMORPG (The Legend of Dragon) in 2011 and an FPS (Assault Fire) in 2012. The studio then switched to developing content for mobile and created a pair of exclusive titles for China’s WeChat social platform in 2013. The following year, Jade Studio merged with 2 other studios in Chengdu and Shanghai to form TiMi Studios.

TiMi’s first major project was a title that their parent company, Tencent, had asked Riot Games to create. Tencent asked Riot to create a mobile version of their landmark MOBA title League of Legends in 2015. Riot declined, claiming that the gameplay and functionality of LoL couldn’t be replicated on a smartphone. Instead, TiMi Studios released a MOBA called Wangzhe Rongyao (Honor of Kings in English) in November 2015. While this wasn’t a direct port of League of Legends, it was a very close replica and enough to give TiMi credit for porting the title to mobile successfully. The title (known as Arena of Valor in the west) grossed over $1.9 billion in 2018, making it the highest-earning mobile game of 2018.

Honor of Kings established TiMi’s ability to develop commercially successful ports on mobile

TiMi continued its streak of popular PC/console mobile ports when Tencent signed TiMi to bring Player Unknown’s Battlegrounds (PUBG) to mobile in 2018. However, Tencent loves to make its internal developers fight over the same prize, even if it means making the same game twice.

TiMi’s port of PUBG was called PUBG: Army Attack. The other Tencent studio involved with PUBG, Lightspeed & Quantum, developed PUBG: Exhilarating Battlefield. Both titles featured PUBG’s signature battle royale gameplay and mechanics ported to the mobile format, though the two studios had different approaches.

PUBG Mobile was developed by Tencent’s Light Speed studio while Timi, who allegedly also was in a race to develop PUBG Mobile, ended up making Call of Duty. Tencent is known to put several of its studios into a race against each other.

PUBG: Exhilarating Battlefield was intended to be a close recreation of PUBG’s PC experience. TiMi differentiated Army Attack by including aerial and naval combat (neither of which are hallmarks of the franchise) and was generally considered less realistic/more arcade-inspired by critics.

Both titles were released for Android and iOS on February 9, 2018, in China. In an interesting twist of fate, Chinese regulators prohibited Tencent from monetizing either game for fear of stoking gaming addiction in children (funny enough this was brought on by TiMi’s Honor of King’s impact on the Chinese market). As Tencent considered the next steps on remedying their monetization issues in China, they took a surprise step by soft-launching globally the more “faithful” PUBG mobile title - Exhilarating Battlefield - with no warning in March 2018. Exhilarating Battlefield (Lightspeed’s game) became PUBG Mobile following a successful soft launch in Canada, while Army Attack was limited to distribution in the Asia market only. TiMi paid the price for taking artistic license when porting the PUBG franchise to mobile - a lesson that would stick with them as they moved to their next major project.

Meanwhile, at Activision, how do you leverage an IP like Call of Duty?

This brings us to Activision and Call of Duty. Activision continually struggled to launch any of their IPs on mobile, especially Call of Duty. Call of Duty: Modern Warfare 2: Force Recon (Glu Mobile, 2009), Call of Duty: Zombies (Ideaworks, 2009), and Call of Duty: Strike Team (The Blast Furnace, 2013) were all attempts to bring the FPS experience to mobile. Many of the reviews of these earlier games took issue with a lack of content and frustrating first-person controls. Activision also tried using the Call of Duty IP in other formats for mobile. As an example, Call of Duty Heroes was a base-building/RTS title that incorporated characters from across the franchise. It was released in November 2014 and was shut down in December 2018.

Starting back when Activision acquired King in February 2016, there were public talks about using King to build a Call of Duty game. King announced that they were working on a Call of Duty mobile title in April 2017, but the game never released. We can only assume that attempts to port Call of Duty’s gameplay to mobile failed, and/or that the company was confused as to what the best approach to mobile Call of Duty was. Should it be a direct port of the gameplay? Should it change the game to be a mobile-first experience?

King was tapped to create a Call of Duty mobile title, but it never got off the ground.

In March 2018, Activision was handed their answer on a silver platter. PUBG Mobile was released by Lightspeed & Quantum and started its meteoric rise to the top of the charts. In August 2018, Activision formally announced that it was partnering with Tencent to create a mobile port of its Call of Duty franchise, and TiMi Studios was tapped to develop the title at GDC in March 2019. One year after Lightspeed & Quantum’s “faithful” version of PUBG became PUBG Mobile, TiMi was given another chance to bring a PC/console shooter franchise to mobile.

The Core Loop

Call of Duty Mobile was developed to recreate the core experience of Modern Warfare and Black Ops franchises in a mobile, free-to-play environment. It was also intended to lower the barrier to entry of the COD franchise by reducing the level of skill required to enjoy the game. This is a big departure from traditional PC and consoles FPS experiences, where the barrier to entry is quite high given the high skill level, mastery, precision and dexterity required to be competitive in this genre.

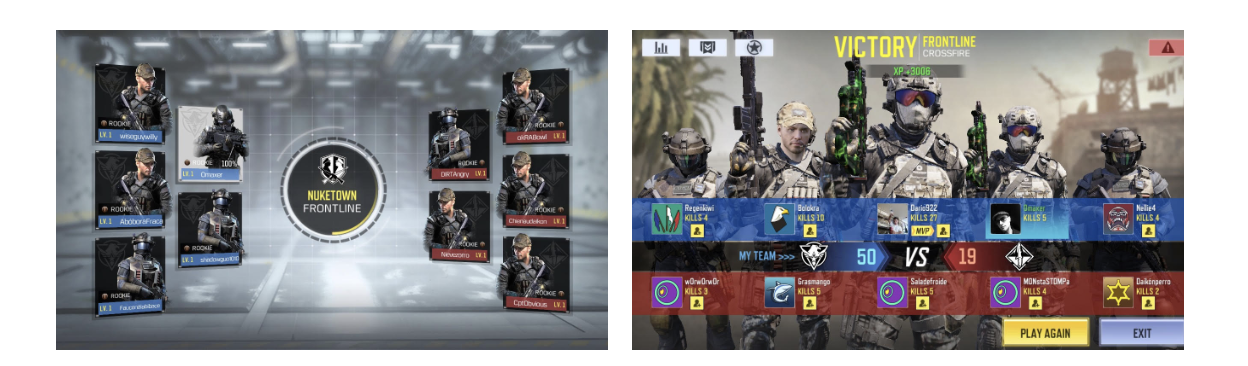

A direct port of the greatest hits of Call of Duty: FPS controls, multiplayer maps

COD Mobile’s core gameplay revolves around taking part in multiplayer combats. Depending on in-game performance, players earn XP, medals, and COD Credits (in-game soft currency). Players then spend those XP and credits to upgrade their weapons and gear.

COD Mobile core gameplay illustration

After the player has earned enough XP by taking part in various battle modes they can level up, which unlocks new weapons and loadout slots.Taking part in multiplayer public battles and performing other tasks in the game also increases battle pass progression.

Combat Modes:

While staying true to its core multiplayer experience, COD Mobile doesn’t want to let go of the opportunity to cash in on the battle royale mode which is all the rage nowadays. The game is divided into 2 major modes: Multiplayer and Battle Royale.

5 vs 5 Multiplayer:

Multiplayer mode includes 7 maps spanning the CoD franchise and several core gameplay modes, including team deathmatch, domination, and search-and-destroy. Matches can either be played in normal or ranked mode, with ranked providing the opportunity to earn additional cosmetics each season.

5 vs 5 MP mode in COD Mobile

Experience earned in matches allows players to level up and unlock new strategic options to take into the arena: new weapons, weapon attachments, lethal grenades, tactical grenades, and killstreak rewards -- just like in Call of Duty.

This mode is a faithful recreation of the COD experience and actually feels more tailor-made for mobile. Multiplayer mode with its short match lengths feels right at home on mobile.

Battle Royale

Battle Royale mode is a recreation of the highly popular Blackout mode found in Call of Duty: Black Ops IV (and takes inspiration from PUBG and Fortnite). The mode launched with a single map, called Isolated. Players earn experience towards the current season as well as their permanent profile. Leveling up their season rank earns players cosmetic items such as class items and outfits. Battle Royale modes restrict the rewards players can be offered; permanent weapon upgrades impact the game balance, which kills the motivation to play.

Battle Royale mode involving up to 100 players in COD Mobile

Why does Call of Duty Mobile retain so well?

Activision has been trying to port Call of Duty to mobile for years, and many other studios have attempted to recreate the gameplay of COD with their own games. But it wasn’t working until Timi nailed the four key elements: controls, early gameplay, nostalgia and session design.

#1 Best-In-Class FPS controls for mobile

When a third-person shooter like PUBG was originally launched on mobile, industry pundits and veteran gamers alike were skeptical of how it would fare on mobile…

Earlier versions of the PUBG Mobile UI attempted to recreate a console control scheme, but felt very clunky.

This is for obvious reasons: there is no way to control an FPS on mobile without shifting towards virtual joysticks and joypad buttons covering up the whole screen. These are nearly cardinal sins for any normal mobile game’s control scheme -- buttons take up a large amount of screen space, players can easily misstep buttons, and it requires players to be tracking far too many systems at once while playing.

Yet something has changed in the last few years on mobile as games like PUBG, COD, and Fortnite have launched. The core audience of players that enjoy playing shooters doesn’t seem to care about all this complexity. In fact, they prefer a direct port of PC/console mechanics than a more streamlined mobile version.

This is the common trap that most mobile shooters have fallen into -- they simplified the mechanics, but also removed the depth. This is the lesson TiMi learned with PUBG Army Attack and the one they were not going to repeat with COD Mobile.

Why is FPS controls such a tough nut to crack on mobile?

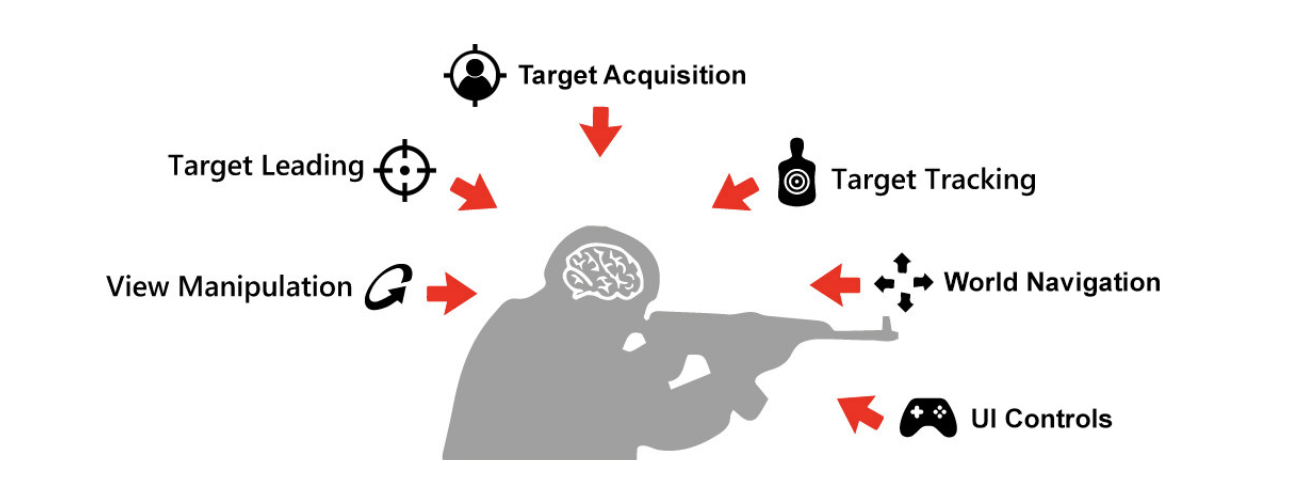

From a pure User Experience perspective, FPS games have traditionally required a high level of mastery and precision. An FPS player is required to juggle multiple cognitive loads of varying magnitudes at the same time while coordinating motor & sensory skills, overcoming the friction of controls in order to achieve their goal. This cognitive load is much greater in magnitude and complexity compared to other hardcore genres found on mobile (RTS, RPG, MOBA, TPS, etc.)

A comprehensive list of FPS heuristics and cognitive loads a player has to manage.

Like a juggler, an FPS player is juggling many cognitive loads at the same time, which leads to a higher mastery curve.

Given the small real estate (screen size) of mobile devices, this problem is even further compounded by Fitt’s law:

Fast movements and dexterity are the hallmarks of FPS games. Players are constantly moving around the 3D world attempting to identify targets and then move their cursor quickly to shoot their opponents. Moving this to mobile only makes things harder. This is one of the fundamental reasons why shooters on mobile have never really worked -- too much cognitive load, and too frustrating to track targets.

So how does COD Mobile attempt to fix this? The game recognizes and embraces two distinct player types: casual and core. They keep the funnel wide by having a mode which keeps the cognitive loads low, and they have a mode where pro players can have all the control they want.

Reduced number of cognitive loads

COD Mobile veryeffectively reduces the number of cognitive loads (mentioned above) a FPS player has to manage by enabling features like auto-firing, aim-assist and CoD’s best-in-class ease of movement, which automates these actions. This emphasis on ease is reflected in the 2 default control options that COD Mobile offers:

These default simplified control schemes give casual players an easier learning curve, along with greatly reduced cognitive load in line with what they are accustomed to on mobile. This approach is known as “Erasing Loads” and you can learn more about it in Om’s previous articles here)

Offer Deep Customization of Controls for Advanced Players

While default control schemes work well for casual players, the “Advanced Controls” offer a wide variety of customization options (in line with PC & console game settings) for hardcore players who are very particular about their preferences and like to heavily experiment & customize UI inputs to their own play styles.

If players want, they can adjust the sensitivity and turn “On” and “Off” upto 25+ parameters from the “Basic” and “Sensitivity” control menus covering everything from auto firing and auto sprinting to the gyroscope and movement sensitivity.

On top of that, advanced controls give the ability to individually scale, move and configure each button/UI item on the HUD, allowing players the ability to literally build and personalize their own user interface. This approach is known as “Easing Loads” via the ‘kitchen sink approach’ and you can learn more about it in Om’s previous article series here.

Advanced mode allows each HUD button to be scaled, positioned or made transparent as per player preferences.

In short:

CoD Mobile tailors to the preferences of both casual and hardcore players in control schemes via reducing the impact of traditional FPS cognitive loads. The control schemes offer a high degree of customization and make the game more accessible, enjoyable and playable on mobile, lowering the high barrier to entry normally found in the FPS genre.

#2 High kill ratios in the early game

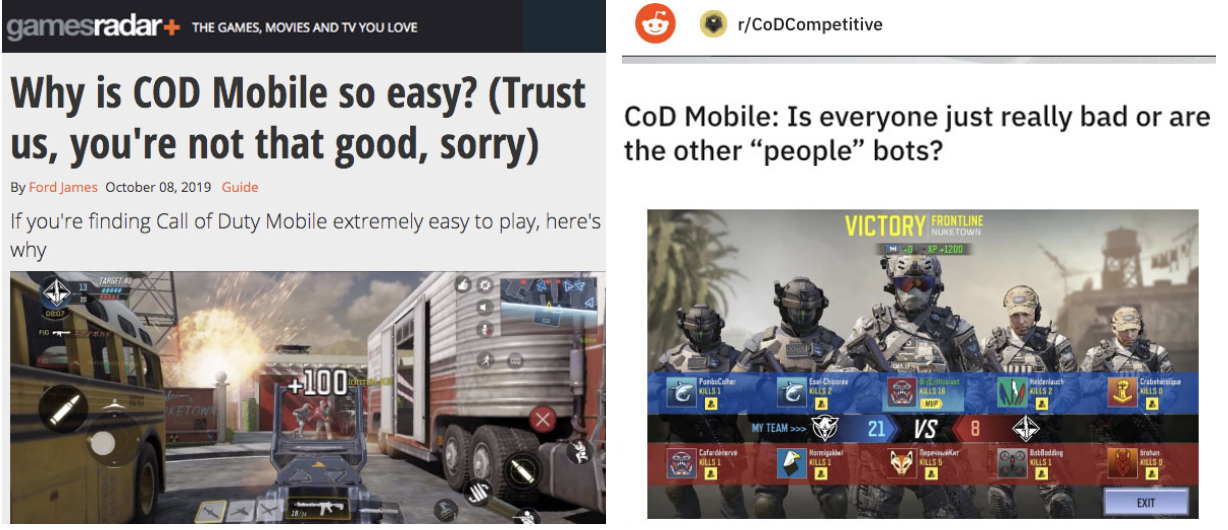

The second reason for Call of Duty’s strong retention profile is that they have a trick up their sleeve: bots. The easiest way to retain players is to make sure they’re having a positive experience during their onboarding. New players in PvP games quickly churn out when matched with elite players early during onboarding, and PvP games have not always addressed this issue. So TiMi found a way to ensure new players would have a positive first-time user experience (FTUE): add bots for target practice.

Articles from Kotaku, Reddit to Gamesradar highlight early “padding” via bots experience.

#3 Nostalgia

TiMi definitely lowered the barrier to entry via adaptive controls and easy bot opponents for new casual players. TiMi hasn’t forgotten their loyal franchise fans either. This mobile version plays like a condensed version of Black Ops and Modern Warfare. The graphics, maps and various modes like MP, Domination, and Search & Destroy keep the pure COD experience intact.

Nostalgia factor is further enhanced by familiar characters like Captain Price, Alex Mason, and Simon "Ghost" Riley, who hardcore CoD players will recognize and appreciate from their previous PC/console experience.

#4 Freedom of Session Design

Lastly and most importantly, TiMi does not restrict the player from playing the game as often or as long as they like. This has been a clear trend over the last few years in mobile game design -- moving away from harsh pacing systems (energy, timers) and towards giving players free rein over their play experience. This gives players freedom over how they want to engage with CoD Mobile, and allows them to play for hours each day. Not only can players freely choose between multiplayer modes (shorter session) and battle royale modes (longer sessions), they can play as much of each as they like.

Looking at retention, there is a clear link between a player’s gametime today and their chance of returning tomorrow. TiMi gives themselves the best shot at retaining players by having endlessly repeatable core gameplay (as proven by the success of previous franchise games) and giving players free rein to play the game for hours each day.

Most developers don’t do this because of the impact on the economy. If players have free rein over engagement, they can consume content or earn rewards too quickly. They can consume too many levels in a Match 3 game, or build buildings too fast in a simulation game. In a PvP shooter, the core loop supports endless play, but the progression economy is limited: levelling up weapons and levelling up your player account has limitations. This is where Call of Duty starts to show its seams -- unlimited engagement is a clear play to retain players, but players will churn if they rip through the economy too quickly.

How Call of Duty Mobile left $100M+ on the table

Call of Duty Mobile’s meteoric rise to the top of the mobile charts stands in contrast to its flattened RPI curve and diminishing daily revenue. To better understand why Call of Duty Mobile is currently struggling to monetize, we will analyze its main competition (and fellow Tencent-developed title), PUBG Mobile.

PUBG Mobile vs. COD Mobile

PUBG Mobile is the incumbent leader in the mobile shooter category. The PC game is traditionally known for its strong battle royale elements, but the mobile installment features a wide number of modes to engage all shooter fans.

PUBG’s battle royale mode is similar to the one in Call of Duty Mobile. Both modes feature 100-player winner-take-all matches, though PUBG has four battle royale maps to Call of Duty’s one.

PUBG Mobile also has its own multiplayer mode called EvoGround. Players can choose from team deathmatch, payload mode (essentially battle royale with high-damage weapon pickups), and zombie horde PvE.

On paper, PUBG and COD are very similar in terms of feature sets. Both have multiplayer and battle royale modes, both focus on cosmetics (through battle passes, loot boxes) to monetize. The only difference is that Call of Duty offers a profile progression system and weapon experience mechanic for its multiplayer mode. So why the stark difference in performance? On paper COD Mobile should perform better given the franchise’s enormous popularity?

However, looking at the details starts to point to problems: weapons and player accounts level up very quickly -- players quickly unlock major weapons and attachments for their favourite guns. After assembling loadouts that suit them, players no longer need the weapon XP system, and no longer chase after unlocking new weapons. At this point, players are just focusing on the cosmetics, and when comparing PUBG’s cosmetics to COD’s, there are very clear issues.

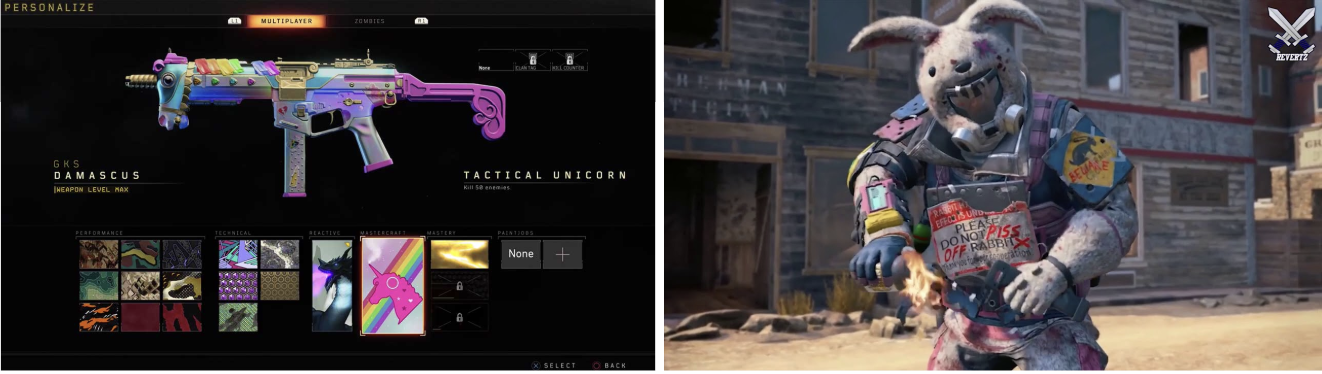

Even with fairly similar themes, PUBG has clearly had a lot more time and focus for offering cosmetics players actually want. Despite being in a modern military setting, players want cosmetics that stand out, regardless of how out of place those cosmetics may be with the serious competitive tone of the game. Look at top cosmetics in Counter Strike: Global Offensive (CS:Go), Apex Legends, Call of Duty and PUBG: despite the “serious” setting, players just want to stand out from the crowd:

Mechano-Rooster-themed limited-time items in PUBG...

Call of Duty Mobile, on the other hand, has fewer cosmetics that have value to players. Whether it was production restrictions, lP restrictions, or a rush to get the game out in time for Modern Warfare (which released 3 weeks later), COD Mobile just doesn’t have a strong selection of valuable cosmetics at launch.

Instead, Call of Duty has attempted to lay out its cosmetic systems early, and intends to slowly bring out cosmetic content that has similar value to PUBG over time. But when the content comes in, will it perform as well as PUBG’s system?

TiMi has decided to take a different approach to how they construct cosmetics for COD Mobile: first by splitting up what cosmetics can be used in either mode, secondly by adding some cunning elements to the weapon skins system.

Weapon Skins

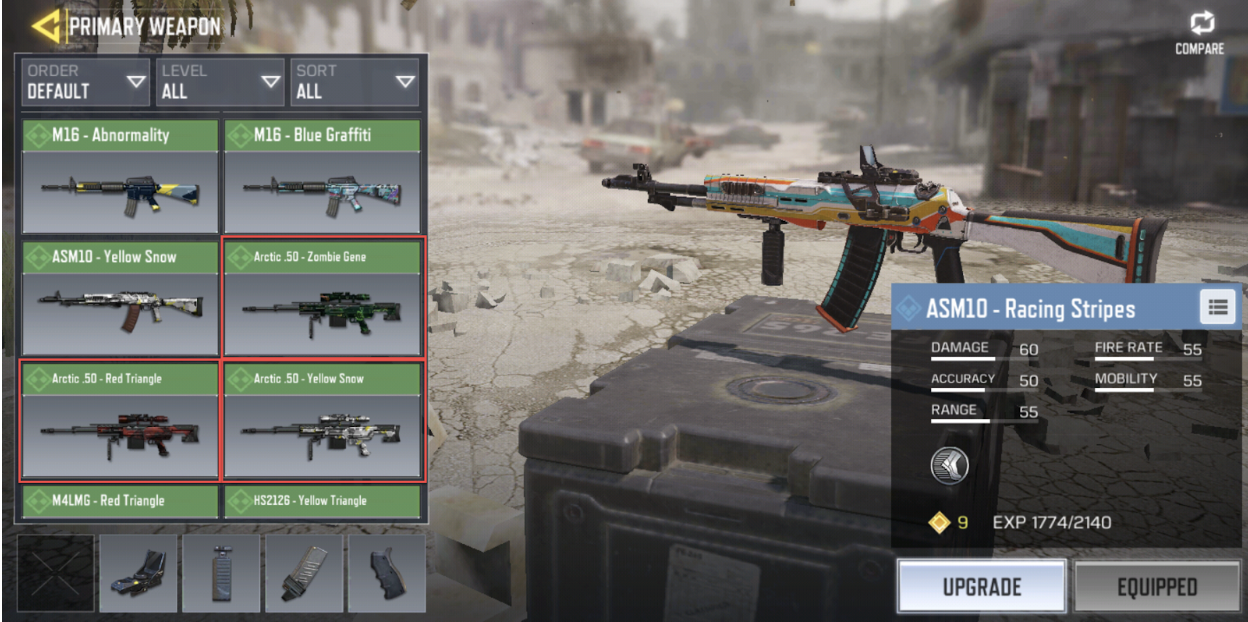

Weapon Skins are the most important cosmetic for FPS style games, so it’s notable that TiMi wanted to try to get more mileage from each weapon skin drop. Three things are worth noting about weapon skins:

Each skin is treated as its own weapon for progression purposes. For example, the ASM10 - Racing Stripes and ASM10 - Yellow Snow are two separate weapons with their own XP progression.

This is significant because players who are invested in a weapon type and get a new skin for that weapon must either spend considerable time or use a significant number of Weapon XP consumables to reach parity in weapon attachments. This is TiMi trying to get people to invest in Weapon XP whenever they like a new cosmetic look for their preferred weapon.

Each weapon skin (read: version) is its own chase.

Acquiring a weapon camo allows a player to equip a weapon in their loadout prior to officially earning that weapon through rank progression. Weapons are unlocked through the player level rewards progression at a rate of roughly one weapon per four levels. Players looking to acquire a specific weapon can bypass the traditional unlock requirements by purchasing or acquiring a skin for that weapon, thus unlocking a variant to use in multiplayer.

Impatience towards earning a weapon through normal progression, such as the Striker auto shotgun earned at level 52, could be a compelling reason for players to purchase weapon skins. This mechanic isn’t specifically called out in the game, but it becomes apparent as players acquire more weapons through the battle pass and loot boxes, and see those weapons in the multiplayer primary weapon loadout screen.

I was able to acquire 3 skins for the Arctic .50 sniper rifle as a level 23 player, though that weapon isn’t given in player rewards until level 67.

Higher rarity weapon camos offer unique traits, such as slightly increased movement speed, weapon range, or magazine refunds. Uncommon (green) weapons don’t have a passive trait, but rare (blue) weapons have one passive and legendary (purple) weapons have two. These traits introduce a pay-to-win aspect to the game, though the benefits of these traits don’t significantly impact match outcomes and haven’t incurred the wrath of the player base yet.

In summary, TiMi is trying to slip in as much gameplay impact and progression time into their weapon skins system as possible. Splitting up the skins between multiplayer and battle royale allowed them to create a skin system which sneakily adds levers for them to create weapon skins that have gameplay benefits (XP increases, perks) as well as push players to use Weapon XP. As a result, when they start adding better weapon skins, they should see more impact than PUBG’s -- but only for players that prefer Multiplayer over Battle Royale.

Mode Specific Cosmetics

On top of a sneaky weapon system, TiMi also has created cosmetic items specific to each mode. In multiplayer, players customize their soldier, primary and secondary weapons, and grenades.

Call of Duty Multiplayer Loadout screen

Battle Royale mode adds several battle royale specific cosmetic slots, including class items (items involved in role specialization), vehicle camos, wingsuits, and parachutes. Knives are included as a cosmetic slot in BR but are treated as secondary weapons in MP. Class items and role specializations are unique to Call of Duty Mobile, and don’t appear in other battle royale games such as PUBG Mobile.

The Battle Royale loadout offers typical customization compared with titles like PUBG, but includes a slot for class items.

Soldier cosmetics (outfits) are shared between both Multiplayer and Battle Royale modes. Players choose a Soldier (a.k.a. player skin) and customize it with headgear, a backpack, clothing, and a suit. Several of the soldiers offered so far are veterans of the Call of Duty Franchise, including Captain Price (from the current Modern Warfare), Ghost (from Modern Warfare 2), and Outrider (from Black Ops IV). Backpacks are the only other player cosmetic item currently available in the game. The rest are expected to come online in future updates.

Most cosmetics are shared between game modes, but not all

This split in cosmetic offerings between Multiplayer and Battle Royale is worth considering for two reasons:

Players only interested in multiplayer or battle royale will derive little value from cosmetics designed for the other mode. We don’t know the split of playtime between Multiplayer and Battle Royale, but we assume that there are segments of the player base that only engage with one mode or the other.

These mode-specific cosmetic items are prominent in the battle pass and loot boxes, and may be turning off potential buyers. If we assume that those mode-specific segments exist, then cosmetics geared towards the mode those players don’t engage with would present little to no value for purchase or acquisition in a battle pass.

Store Offerings

What CoD Mobile currently lacks in quality cosmetic offerings, it tries to make up with quantity. The store offers the following:

Crates (loot boxes)

A la carte cosmetics (including weapon skins, player skins, sprays, etc.)

Weapon XP cards

CoD has two currencies: Call of Duty Points (COD Points) and Credits. COD Points are purchased in packs with real money (just like the franchise’s PC/console counterparts), while Credits are earned in-game and through battle pass rewards.

Players can buy select weapon skins and sprays with Credits through a designated tab in the store, but the rest of the items can only be purchased with COD Points (premium currency). Interestingly, items sold for Credits cannot also be purchased with COD Points, giving the player no option to bypass the grind of earning the soft currency in-game. These items are almost entirely comprised of weapons, and 5 of the 10 weapons are rare-level rarity (would be worth ~$14-20).

Note the price on ATV - Orange. Elite PMC to its right is the only soldier currently offered, and costs USD equivalent $14.85

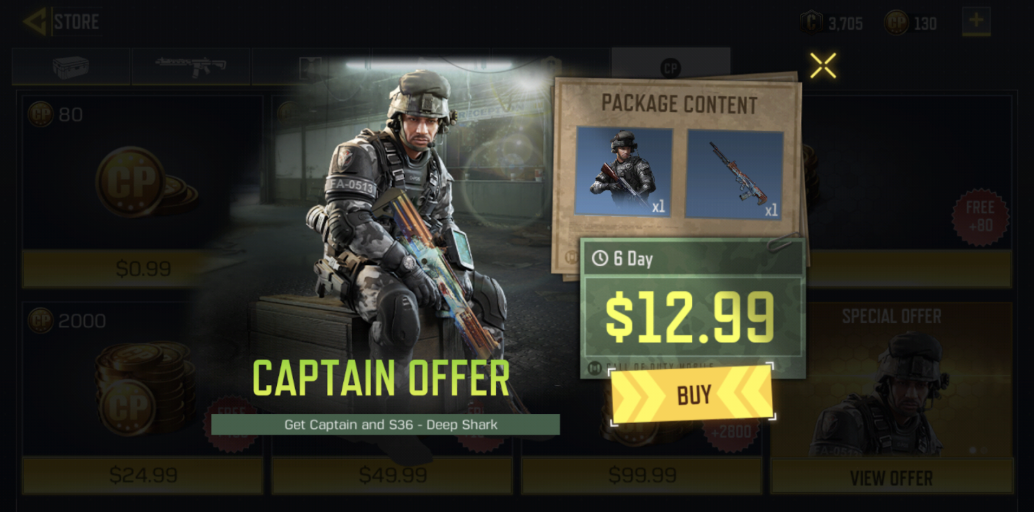

The store also offers time-limited bundles that generally contain a combination of soldiers, weapon skins, and credits.

Bundles are offered for real money, and always include 1 weapon skin

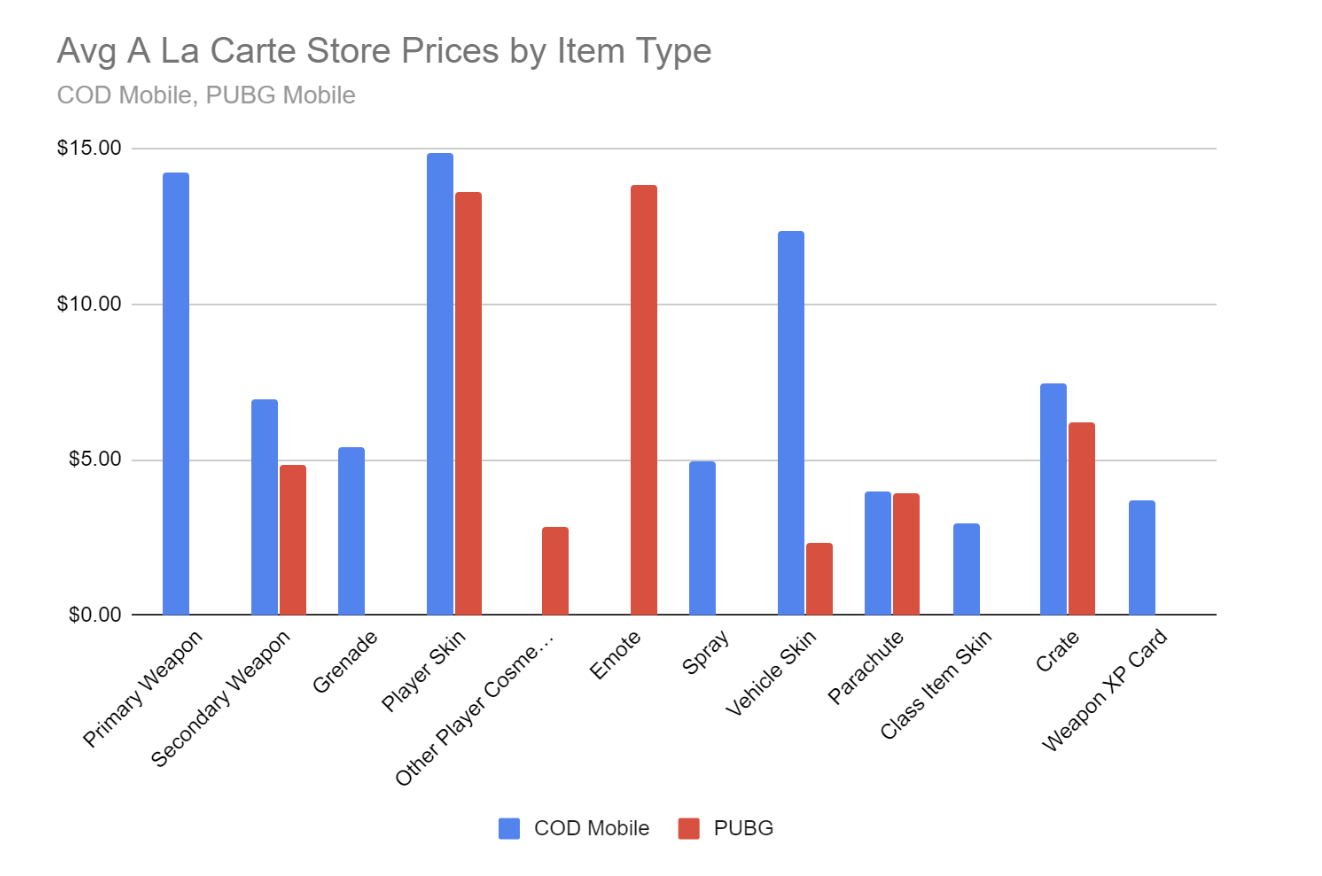

Individual primary weapon skins and vehicle skins are currently the most expensive items in the store. Primary weapons make sense because they are the most visible cosmetic and grant minor combat advantages, but vehicle camos are mode-specific and situational at best within battle royale. They are more expensive even than 10 crate packs and the soldiers currently offered.

PUBG Mobile has a similar monetization strategy, with a combination of a la carte items offered for hard currency and soft currency as well as a selection of loot boxes. As expected, PUBG Mobile’s offerings are a lot deeper for most cosmetic slots. Player cosmetics have an incredible amount of depth: there are currently 58 outfits for sale, ranging from $1.88 to $107.25 USD equivalent. Interestingly, primary weapon skins are only available through the Royale Pass, loot crates, or Silver, and can’t be bought with premium currency. COD Mobile’s average item price equivalent in USD is higher than PUBG Mobile’s for every category in which they overlap.

Overall TiMi is operating by the book with their shop selection -- offering a wide selection of prices and content with clear value for differentiating cosmetics. However, TiMi is playing a dangerous game by pricing single items above their main competition without economy depth.

Loot Boxes

Both Call of Duty Mobile and PUBG Mobile offer time-limited loot boxes as a way to buy cosmetic items. Both games offer these loot boxes in sets of 1 or 10, and provide a 10% discount for buying the bundle of 10. Both games also disclose their loot box odds, although Call of Duty has gone one step ahead of PUBG by disclosing the odds per loot box item, and not just per item rarity.

Legendary weapon skins have a roughly 1% chance to drop in CoD crates. Rare and uncommon weapons both have an average 3% chance to drop, while Credits (soft currency) have an average 10% chance to drop.

PUBG only discloses rarity odds, but in those we can already observe slight differences in item payout:

Analysis of COD Mobile’s season weapon crate and PUBG Mobile’s Lucky Crate shows that PUBG’s crate offered a higher item drop rate across rarities when soft currency and consumables were factored out. In other words, PUBG crates are more likely to reward players with real items across the board. This is to be expected given the prominence that loot boxes have in PUBG Mobile’s economy. COD Mobile’s stingier drop rates could hurt the game if items in their loot boxes aren’t considered valuable enough for players to try their luck.

Battle Pass

At first glance, the Call of Duty Mobile battle pass resembles PUBG Mobile’s Royale Pass in a lot of ways. Both battle passes extend the length of a season (roughly 2 months), and each game offers a free pass and a premium pass with 100 tiers. Both also give you the option of skipping tiers by paying with virtual currency, though their method is slightly different. CoD sells tier skips in packs of 1, 5, 10 or 30 with no volume discount, while PUBG sells tiers individually and prices bundles linearly.

Both games sell a normal and deluxe version of their paid battle pass. CoD’s Premium Pass costs 800 COD Points (~$10) that unlocks the battle pass and gives rewards up to the player’s current free battle pass tier. In addition, CoD offers the Premium Pass Plus for 2,000 COD Points (~$25) that lets the player immediately skip 25 tiers, making the climb to the end of the season somewhat easier. Both the Premium Pass and Premium Pass Plus also unlock Elite Tasks, a set of challenges that allow players to earn significant experience towards their battle pass.

PUBG also has a premium and premium plus variant to its battle pass. The Elite Upgrade costs 600 UC (~$10) and grants access to the paid battle pass and Elite Missions, similar to Elite Tasks in CoD Mobile. Elite Upgrade Plus costs 1800 UC (~$30), and also provides an immediate 25 tier skip. CoD’s high-end battle pass is $5 less than PUBG’s, but there are other factors that make CoD’s premium pass less attractive overall.

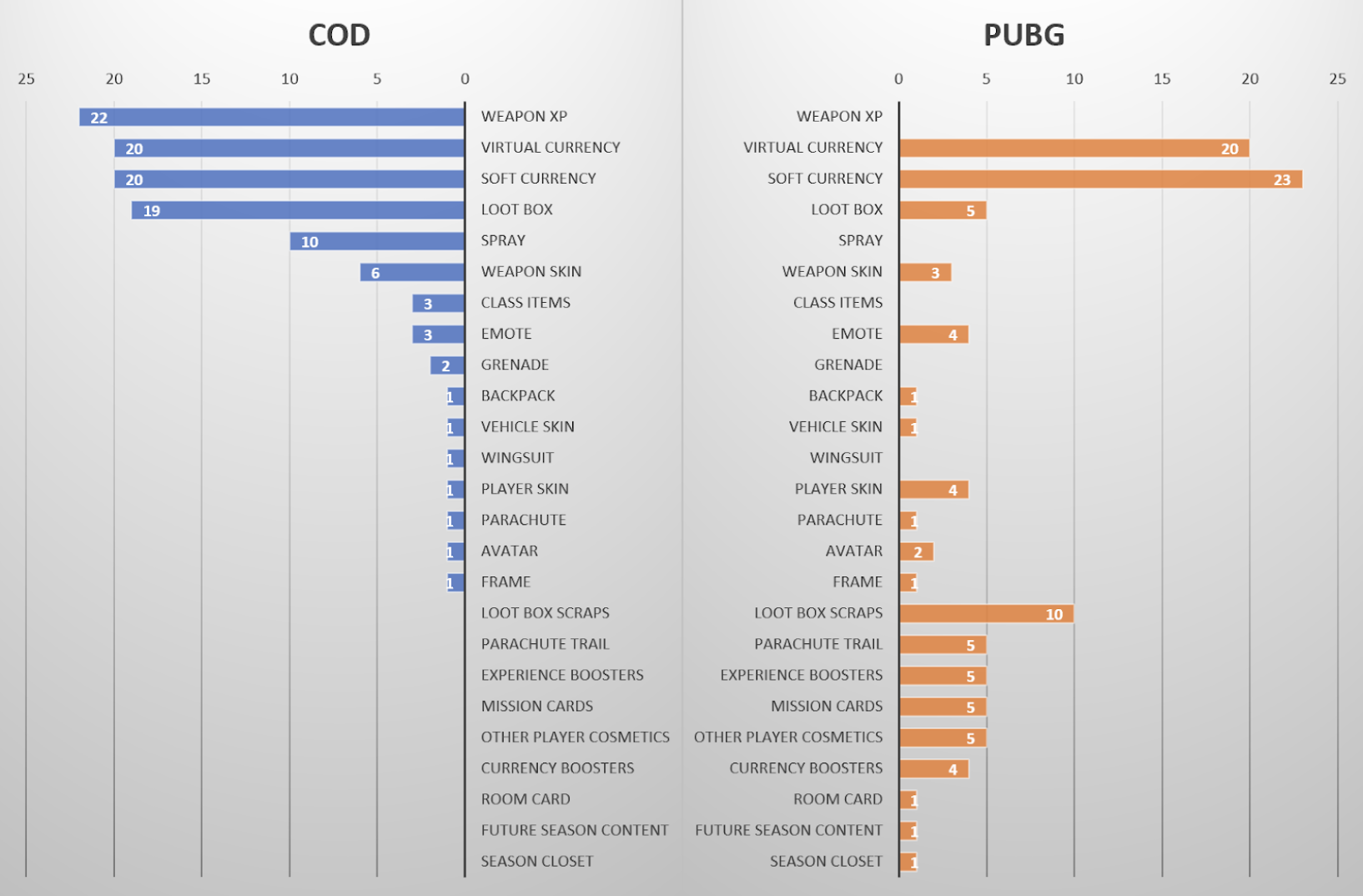

The two battle passes in question start to show marked differences when considering their contents. CoD’s premium pass offers 112 items over 100 tiers. The 5 most common items found in the CoD Season 1 Premium Pass are:

Weapon XP Boosts (19.6%)

COD Points (Hard Currency) (17.9%)

Credits (Soft Currency) (17.9%)

Battle Pass Crates (17%)

Sprays (10%)

The Battle Pass Crate contains a potential additional 22 cosmetic items and 2 weapon XP boosts the player might earn when they open the crate. The cosmetic items offered in the crate aren’t offered directly through the battle pass, giving players a reason to continue earning Battle Pass Crates throughout the season. The odds for receiving the rarest weapon skin in the crate, DL Q33 Red Action, is 0.20%, while the most common is a single Weapon XP boost at 8%.

PUBG’s current Season 9 Elite Pass has 102 items over 100 tiers. The five most common items found in the PUBG Mobile Season 9 Elite Pass are:

UC (Hard Currency) (19.6%)

Silver (Soft Currency) (13.7%)

Classic Crate Coupon Scrap (9.8%)

RP (Soft Currency) (8.8%)

Parachute Trail (4.9%)

The Stronghold Crate found in the Season 9 Elite Pass has 2 legendary and 6 epic rarity cosmetics, along with 4 offerings of Silver currency (5-20 each). Legendary items have a 2% drop rate, epic items have an 18% drop rate. The Silver currency offerings make up the remaining 80% probability. These crates can also be purchased for 60 UC ($0.99) a la carte, unlike CoD’s Battle Pass Crates (which can only be earned via gameplay or tier skips).

Item distribution in COD Mobile Season 1 Battle Pass vs PUBG Mobile Season 9 Royale Pass

The first issue for CoD’s paid battle pass offerings is in the rarity of the items offered.

These numbers are especially damning next to PUBG, which has a more expansive rarity scale and offers more items in the highest rarity in the paid battle pass:

The second issue for Call of Duty’s battle pass is that the items offered don’t offer any aspirational goal via sets. This dovetails with the earlier point about the game’s current lack of cosmetic slots for players. PUBG’s Season 9 Royale Pass includes 13 items for 3 items sets. The main set, Draconian, accounts for 8 of those items alone. Those items are distributed through the Royale Pass from tier 25 to 100, giving the player a strong reason to purchase and complete the entire battle pass before the season ends.

Monetization Summary

Call of Duty’s low RPI curve at 1 month post-launch indicates issues with their monetization methods:

Priority on cosmetic creation is shallow and wide. An FPS title like Call of Duty would benefit most from prioritizing high quality, differentiated weapon skins. Call of Duty’s cosmetic offerings include standard fare such as weapon skins and emotes, but also includes items such as lethal and tactical grenade mods that the community has generally ignored. Weapon skins and weapon-related cosmetics are the most important element in a FPS title, and Call of Duty Mobile need look no further than its own franchise for inspiration on ways to further augment and monetize their weapon cosmetics offerings.

Low cosmetic variety for players doesn’t lay a foundation for strong loot box and bundle monetization. Call of Duty has a lower number of player cosmetic options than PUBG Mobile. This creates a ceiling for selling individual player cosmetic item sales (which the store’s layout emphasizes), and limits the potential for bundling player cosmetics together. Introducing more player customization slots and incorporating set items into both the battle pass and bundles will cause players to spend until they’ve completed the set.

The premium battle pass is too heavy on Weapon XP upgrades. It’s become commonplace for paid battle passes to contain both hard and soft currency in lieu of cosmetic items, but Weapon XP cards are currently taking up too much space to make the battle pass a compelling buy compared to PUBG’s Royale Pass. Call of Duty should lower the number of Weapon XP cards offered and replace them with other cosmetics.

Individual item pricing scheme doesn’t align with player-perceived value. Call of Duty gets a slight break in regards to comparison to PUBG over individual item sales since the latter doesn’t offer any. However, Call of Duty’s individual store item prices are not in line with player-perceived value, such as vehicle skins (which are particular to Battle Royale mode) that are more expensive than soldier outfits. Holding rarity constant, gameplay changing items such as weapon skins should be most expensive, followed by player customization, followed by other lower value cosmetics.

Recommendations - what we would do

CoD’s revenue turnaround will be largely determined by its ability to produce quality cosmetics that are perceived as valuable in either Multiplayer or Battle Royale mode. To do that, TiMi will undoubtedly improve its formula to start producing more content which drives players to purchase. Our recommendations are to focus on providing a deeper chase for the most valuable cosmetics in the game to drive their value:

Recommendation #1: Double Down on Weapons

The first and most important cosmetic touchpoint in an FPS/TPS title are the weapons themselves. Counter Strike: Global Offensive (CS:GO) is a 7-year old FPS title with a robust cosmetic item economy, and offers a wealth of data on the importance of weapon skins in an FPS title. According to DMarket, the majority of all purchases in CS:GO’s economy were weapon skins by a large margin (62%), followed by loot boxes and loot box unlock items (29%).

Left: reactive camo skin from COD: Black Ops IV. Right: new Cosmos skin in COD Mobile.

Weapon trinkets and death effects should be equippable across weapons of the same type, since each different camo is treated as a separate weapon in multiplayer mode. All three of these weapon cosmetics would be highly visible in either multiplayer or battle royale.

The reason to add better weapon skins is not just to drive purchases. By making a new tier of weapon skins, they’ll be reinforcing their Weapon XP system and Weapon Perk system, which is clearly TiMi’s ace in the hole for COD Mobile.

My assumption is that TiMi will be pairing their top end skins with additional gameplay impact, which will drive an even deeper chase for the cosmetics players want. So not only do you want the amazing weapon camo, but you want the one with perks that benefit your playstyle.

Recommendation 2: Cosmetic Sets

The second hurdle CoD has to overcome is its Soldier customization. At present, there are only 5 elements a player can customize about themself. For comparison, PUBG players have 8 different elements to customize their soldier.

PUBG Mobile has more customization options for players to choose from.

This is the key element that allows PUBG Mobile to create a compelling chase to collect all elements of a set to make a full outfit.

CoD can be forgiven for not having the same number of items available that PUBG Mobile has after only a month on the market. However, the cosmetic customization system is not currently configured to offer a wide variety of valuable items or drive players to complete sets. The most compelling outfits are one-size soldier skins that provide no lengthy chase to acquire.

More slots means there is more opportunity to create a chase for cosmetic sets -- utilizing the loot box mechanic and battle pass mechanic to give a path for players to collect ‘em all.

Recommendation 3: Quality over Quantity

The most important recommendation regarding COD Mobile’s performance currently is the lack of quality cosmetics. PUBG Mobile has a far stronger offering of cosmetics which they can give out in their battle passes and their loot boxes.

For TiMi, they need to de-emphasize shop offerings for cosmetics with low player-perceived value. They should reduce their emphasis on lethal grenades and tactical grenades as cosmetic item slots. These items have limited cosmetic value in even the best of circumstances. Grenades barely catch the player’s attention in the UI and are completely unnoticeable when thrown in combat.

Development resources should prioritize the creation of cosmetic assets that have significant player value -- the items that players see and use the most often. This means being big and bold with their weapon skins and outfit sets. Take a page from Black Ops and CSGO’s playbook: don’t be afraid to go wild with skins, especially when themed to keep players collecting new cosmetics over time.

Who wouldn’t want the unicorn gun?

The Tencent Playbook: Come, Stay, Pay

Call of Duty Mobile’s 100M+ downloads, stellar reviews, and high retention numbers have shown this is a massively successful mobile title. Its low revenue-per-download tells a different story about the value of items currently offered in its store and battle pass. However, just because it has started off weak, we should not discount Tencent’s ability to turn this around.

Tencent is known for pushing a “Come, Stay, Pay” model to its developers:

Come - driving a large audience to the game

Stay - retaining those players

Pay - monetizing them (over time)

COD Mobile is a massive success for both Activision and Tencent, especially on the “Come” and “Stay” fronts. So now we should see Tencent pushing towards “Pay”.

TiMi has laid the groundwork for a high-monetizing game, at the same level as PUBG Mobile. Their additions to the Weapon XP system + Weapon Perk system should give them an advantage over PUBG in the long run -- even if the numbers don’t support this yet. TiMi knows how to create a successful cosmetic economy from Honor of Kings -- it’s clear they are biding their time to execute on COD Mobile’s.

PUBG Mobile’s RPI (US Only) - Tencent have proven they can grow RPI quickly

In the coming months it’s likely that TiMi will start pumping out more high-end weapon camos, more cosmetic sets, and more soldiers that give the differentiation that players are hungry for. As these offerings shift away from cheap “camo grenades” to expensive “rainbow unicorn guns”, we expect to watch the RPI rise, similar to PUBG Mobile.

This will be a battle: the grudge match of TiMi vs Quantum Lightspeed duking it out to see who can build a more successful game. The only question to me will be how many players will be left for TiMi to retain, and why didn’t they offer some of these items at launch?

While Tencent may have left $100M on the table by not launching with strong cosmetics, they will be using the time-testing Tencent formula to turn this game around and have a shot at another $1B franchise.