2019 Predictions: #1 Only One Way to Climb to the Top of the Puzzle Games Category

Welcome to our yearly prediction post. Before you jump in, let me sum up how we arrived to the predictions.

First we created a taxonomy together with Game Refinery dividing the games market into four different genres: Casual, Mid-Core, Casino and Sports. Then we further broke down the genres into categories based on games and then we further divided each category into a sub-category based.

As as example, Candy Crush Saga is in a) Casual Games genre > Puzzle Games category > Match & Blast sub-categoryWe pulled the data of top 500 games (excluding China, Japan and Korea) from Sensor Tower and aligned the data with the genres, categories and sub-categories.

Once we had a clear view of what happened, we got together and wrote our predictions.

Please, take the numbers presented with a giant grain of salt. They are there more to show trends and to give rough estimates.

To make sure you don’t miss all the following predictions, please do subscribe to the Deconstructor of Fun very infrequent newsletter.

Special thanks to Miikka Ahonen and Jussi Huittinen for sacrificing their evenings and helping me to make these predictions.

Puzzle Games - Say hello to Advanced Casual and Genre Mashups

Casual games are the second largest genre in mobile games. In 2018, Casual games in the West accounted for $8.1B in net revenues. The Puzzle category, which is divided into four different sub-categories, is responsible for 60% of in-app purchase revenues in all casual games reaching up to $3.8Bin 2018. In 2017, the category made strides in monetisation as installs staled while the revenues grew rapidly. In 2018, however, the Puzzle category experienced more modest growth of revenues while the installs remained stable.

While mature, the Match & Blast sub-category still grew revenues by almost a third. Most revenue growth was nevertheless in Board and Word games, which likely grew even more if ad-revenue were to be accounted in this chart.

The competition on the top stayed the same in 2018: King, Playrix, and Peak continued to dominate the top-10 grossing list in Puzzle games. In other words, last year the category continued to mature with ever fewer games breaking into the top. That said, Puzzle is by far the largest casual games category. Even when it’s not growing, it is full of opportunities in the mid-tier. On one hand, established products such as Charm King managed to grow even in challenging market conditions. On the other hand, more recent contenders such as Matchington Mansion and Home Design Makeover have built solid business with arguably limited product innovation but clever positioning or marketing.

All in all, in this fiercely competed market it looks more and more like nailing down retention and monetization are not enough to create a successful product: you need to nail down your marketability as well. Funnel conversion is the new LTV.

That’s the big picture. And as you very well know, we here at Deconstructor of Fun don’t stop at the big picture. So, to better understand and deconstruct the category, we broke it down to four sub-categories.

Match & Blast - three distinctive giants and the rest

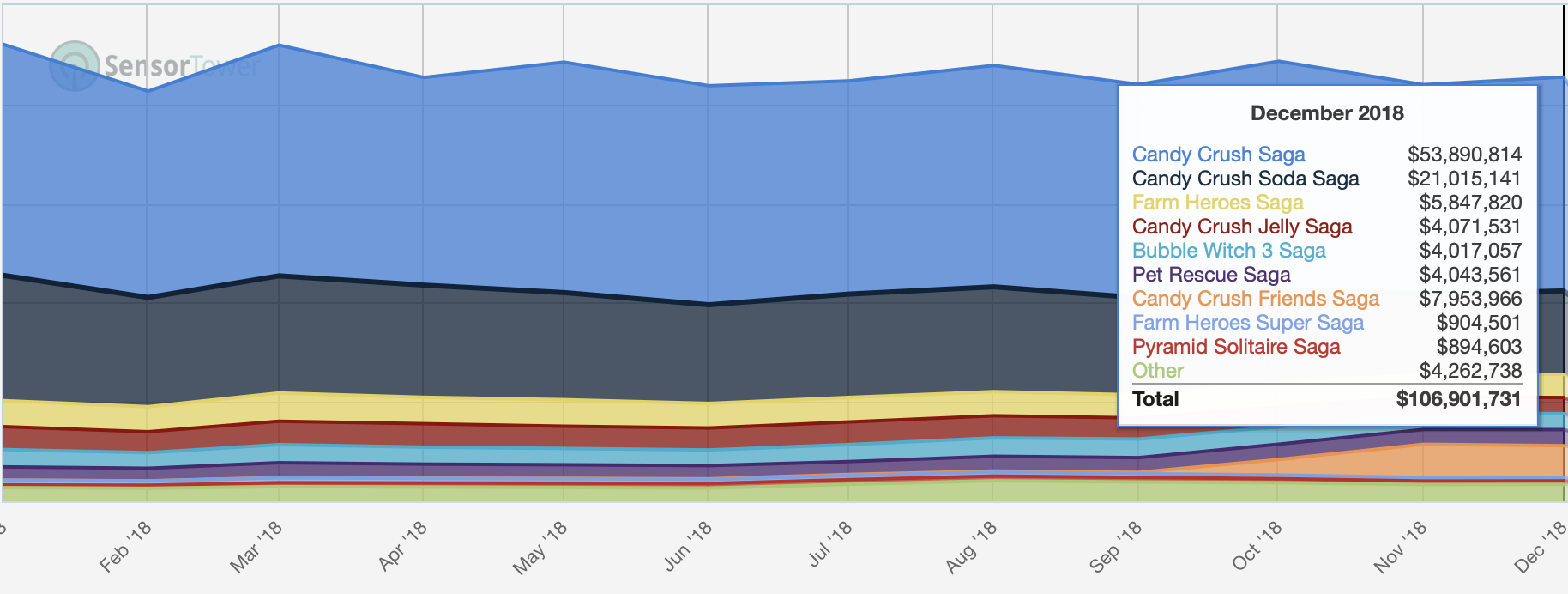

It’s now 7 years since King’s Candy Crush Saga burst onto the iPhone screens and on top of the charts. And for the 7th year in a row, King’s genre defining hit continues to rule the category amassing 23% of all revenues and 22% of all category installs. And the first of the follow-up titles, Candy Crush Soda Saga is not doing too shabby either with a second spot and 11% of all category revenues. The third game in the top-10 of the sub-category is yet another Candy clone, Candy Crush Jelly Saga with a solid 2% of the sub-category revenues.

King continued to lead the Match & Blast sub-category in terms of revenues during 2018. Candy Crush franchise brings over 60% of all portfolio revenues.

Other King games and franchises have fallen out of the top-10. Bubble Witch Saga 3, Pet Rescue Saga, and Farm Heroes Saga have all fared significantly worse that Candy Crush games, though they too have reached revenues, which would more than please several mid-size developers.

When analysing King’s portfolio bit further, it is clear to see two major issues:

Firstly, King has launched over the years sequels to its few staple franchises and with only one exception (BubbleWitch Saga 2 and 3) the sequels have performed worse than their predecessors. Candy Crush Friends Saga looks to break the spell and fair better than Candy Crush Jelly Saga.

Secondly, King has launched several underperforming titles, such as Diamond Diaries Saga, Scrubby Dubby Saga, Puzzle Cats and Diamond Digger Saga, without committing to market them. This is an uncommon practice undertaken during last year or so. The reasons for this are unknown but one could assume King does it to keep its developers happy - and to gather learnings from live operations. After all, we work on games to get them into the hands of players and if the publisher keeps on cancelling games in development, developers making them will eventually leave.

King has been trying to expand its portfolio with sequels and new franchises but it hasn’t paid out as additional growth but rather kept the Candy Crush franchise from declining. King’s new game, Candy Crush Friends, seems to be breaking the curse of ever weaker performing follow up titles as mentioned. But the game’s growth has staled just a few months in at it looks to fair far worse than Soda Saga and the all-mighty original Candy Crush. Whole Candy Crush portfolio hasn’t grown despite a massive launch of a new game. In other words, without Candy Crush Friends the Candy Crush Franchise would be as of date facing minor decline.

Candy Crush Friends Saga broke the curse of ever smaller follow-up titles and became the third largest Candy Crush game. Without it, the Candy Crush franchise would have declined YoY. What’s interesting to notice is that there’s seemingly no cannibalisation when launching a new Candy Crush game.

Meanwhile the competition has gotten more fierce year by year. Playrix and Peak Games have gained ground on King with meta game innovation (Playrix) and unprecedented focus on optimisation (Peak). In fact, Playrix’ net revenues in 2018 grew by 40%($616M> $866M) while installs fell by 7% (145M> 135M) compared to 2017. Peak’s year-on-year revenues on the other hand almost doubled in 2018 ($153M> $440M) and the installs also grew by 46% (61M> 89M). Playrix’ took 20% of all Puzzle category revenues with Fishdom, Homescapes and Gardenscapes while Peak Games cemented its place as the third largest puzzle games company capturing 12% of category revenues with just two games, Toy Blast and Toon Blast.

Playrix’ took 20% of all category revenues with Fishdom, Homescapes and Gardenscapes while Peak Games grew it’s category revenues to 12% powered by Toy Blast and Toon Blast.

Just like the revenues, installs also stabilised for the top three developers during 2018. This us largely due to lack of new hit games and most importantly, the constant increase of CPIs. The only growth spurs are created by the launch of new games such as King’s Candy Crush Friends(Oct18),Bubble Witch Saga 3(Jan17) and Farm Heroes Super Saga(Jul16), Playrix’s Homescapes(Sep17) and Peak Games’ Toon Blast(Jan18)

The top 10 Match & Blast games take almost 80% of all category revenues leaving games like Pet Rescue Saga(King),Gummy Drop(X),and Panda Pop(JamCity) with all with less than 1% of all revenues each. To make the entry into the top-10 even more difficult - and expensive - it is clear that IP has little-to-no benefits when competing for Match & Blast players. Angry Birds, Family Guy, Wizard of Oz, Disney Emoji Blitz, Snoopy Pop and Frozen Free Fall are all games far outside the top-10.

Matchington Mansion and Home Design Makeover (just outside top 10) combined strong marketability with proven meta game. Product positioning, aggressive performance marketing, gameplay innovations and rigorous optimisation are the absolute prerequisites to reach the top of the category.

So, how to break into the top of this highly mature yet highly lucrative category? Well, there seem to be 3 approaches:

Playrix’ success in the category is driven by meta and gameplay innovations that result in higher LTV supported by a portfolio effect.The LTV for puzzle games is calculated by player’s value for the publisher’s portfolio of puzzle games because players tend to play several puzzle games at once. Appetite to play several puzzle games at once means that these players are also more easily cross-promoted from one puzzle game to another. That’s why Playrix growth has escalated after the launch of the second title Gardenscapes and third title Homescapes. With three well monetizing puzzle games, the publisher is able to purchase users at ever higher CPIs and ever longer pay-back-times.

The seconds success case is Peak Games (aka. “the Supercell of Puzzle Games”), which is unrivaled in its focus. The company is known for extremely small and highly nimble teams of around 15 developers (compared to teams of well over hundred at King and Playrix) focusing tirelessly on tile-blast titles. Compact size and focus on one type of gameplay not dominated by the market leaders allowed Peak to carve its niche and grow it through rigorous optimisation.

The most recent case is the on of Matchington Mansion by Firecraft Studios, which looks and plays very much like Playrix’ Homescapes. This game that improved from $3M a month run rate to making almost $11M a month in net revenue in 2018. How did they do this? According to our analysis, the main portion of innovation came on the marketing side. For example, in one of the high performing creatives for the game the rooms are on fire and the player has to put out the fires in. As the CPI was lowered, the game set out on a growth path making it the breakthrough puzzle game of 2018.

Action Puzzle - the old guard

The category as a whole is dominated by Rovio’s Angry Birds 2, which is responsible for the lion share of all installs and revenues. The other top games in this sub-category are Plants vs. Zombies 2, Angry Birds Friends and Diggy’s Adventure. In other words, the category is filled with very“seasoned”games ranging from the 7 year old Angry Birds Friends to the soon three year old Diggy’s Adventure.

Top 5 Action Puzzle games. Angry Birds franchise grab a solid 70% of category revenues.

The growth of the sub-category can be almost purely attributed to the marvellous live operations of Angry Birds 2, which we deconstructed a while back.

read: How Angry Birds 2 Multiplied Revenues in a Year

Other Puzzle - the comeback of hidden object games

Other Puzzle games is an interesting sub-category in Puzzle because it has been merging rather simple puzzle game mechanics such as hidden object and cards with well designed meta games. This has resulted in an impressive growth of revenues during the last year from games that were launched well before 2018.

Merge Dragons and June’s Journey are the rising stars of the category. Arguably these games got their companies acquired as Gram Games was picked by Zynga and Wooga got acquired by Playtika

Gram Games’ (Zynga) Merge Dragons has been the true star of this category. The game has tripled its run rate while at the same time nearly doubling its monthly installs. Another star in the category has been Wooga’s June’s Journey, which has quadrupled its run rate in a year. June Journey’s installs also doubled when comparing the beginning of 2018 to the end of the year. Meanwhile, Hidden City from from G5 has declined a during the 2018 while MyTona’s Seekers Notes stayed stable.

Board, Word & Trivia Games - revenue bazinga in English speaking countries

During 2018 the sub-category of various board games has doubled its IAP revenues while keeping the install level stable throughout the year. Now please keep in mind that the IAP net revenues in the category were bit over $10M a month in the beginning of 2018, so the overall increase in Dollars hasn’t been that substantial.

Board and Word games grew its IAP revenues tremendously during the 2018. Keep in mind that ad revenues account for additional 25% to 75% of revenues depending a game.

The impressive growth of IAPs doesn’t tell the real story of the sub category. It’s not a secret that games like Words With Friends are designed to generate massive ad revenues for the publisher. With the constant increase of CPIs we have also seen increase in eCPMs, which has together with ad monetisation innovations led to increase in ad revenues. In other words, the IAP revenues are mere an indication of the true desirability of the category.

The only significant limitation for this sub category, and most specifically word games, is the geographc limitation 90% of all revenues have traditionally come from US and other English speaking countries. This hasn’t changed during 2018.

PUZZLE GAMES in 2019:

Match & Blast

Product positioning, aggressive performance marketing, gameplay innovations and rigorous optimisation are the absolute prerequisites to reach the top of the category. More and more mashups, following the steps of Home Design Makeover and Matchington Mansion, will enter and do well in the category.

Expect the creatives of Match & Blast games to reach new highs or lows, depending how you view it. Funnel conversion and decrease of CPI will be chased with all-means-available.

Marketing payback times will be over a year for top games. This will further close the market from players with not differentiated enough games and most importantly - not big enough war chests to run user acquisition at scale.

King will go all-in on Candy Crush Franchise. They will follow Peak and Playrix with Candy Crush Tales(Gardenscapes)and Candy Crush Cubes(ToyBlast). This will put Candy Crush Franchise one a moderate growth and arguably put King onto a road of being a follower instead of a leader.

Playrix will launch an additional title to strengthen its position as the second largest developer in the category

Peak will focus on profitability after years of hyper growth. Increased profitability will potentially lead the company to a second largest exit in Puzzle Games (after King’s IPO).

Action Puzzle

Expect the category dominated by Angry Birds games to grow boosted by the Angry Birds 2 movie.

Board & Word

Board and Word games will continue to grow revenues through their inherently social game loop and strong ad monetization integration

IPs will continue to offer no competitive advantage in the category

Other puzzle

Merge Dragons will receive several follow-up titles from Gram and others. Yet none of them will come close to the success of the original game

Hidden object games will slow down the growth due to over-saturation. Focus will shift on lowering the CPI with brand integration and new themes as well as further optimising and emphasising the meta-game.